Where do we stand now?

Is it time to get out of the market?

Or get in?

Most people don’t know…

[ad#Google Adsense 336×280-IA]Why?

Because they have no frame of reference…

They don’t know how to size up today relative to any other time in the markets.

My good friend Meb Faber came up with a simple solution for you on our latest Inside True Wealth podcast…

Meb talked about the “the four states of the market” when I asked him if he was more of a “value” investor or a “momentum” investor.

Here’s what he said about value and momentum:

It’s sort of like talking about politics or religion, right? Many people are either firmly Republican or Democrat, or Christian or Muslim or Hindu or whatever it may be. And that’s the way it is with value and momentum. Most people are one of either… To be able to have both perspectives, put them in your head, and not go crazy is rare.

Meb does keep both perspectives…

If you look at a very simple example, which is the U.S. stock market, you can put it into a box with four possible states based on trend and value.

So you have the best state 1) cheap and going up. Then the next best is actually 2) expensive but still going up, which is where we are now in my mind. And then it goes to 3) cheap but going down, and the worst possible state is 4) expensive and going down.

Right now, Meb sees us in the second best of the four states of the market – expensive but still going up.

His big concern is that if the trend switches to going down, then we enter the worst state of the market – expensive and going down. Meb says:

The bad news is you could flip from one of the better states right now, which is what we’re in – expensive and going up – to expensive and going down.

And so that, in my mind, I see as kind of the signal to batten down the hatches. You know, we’ve been in this incredible bull run six years going on, and at some point, the trend will change.

So how do you get out? Meb said:

We did a paper called “Learning to Love Investment Bubbles” that looked at the most famous bubbles in history, so everything from Japan in the ’80s, to other types of bubbles, and using something just as very simple as a 200-day moving average to exit… Just to say, “you know what, I’m gonna get out at some point.”

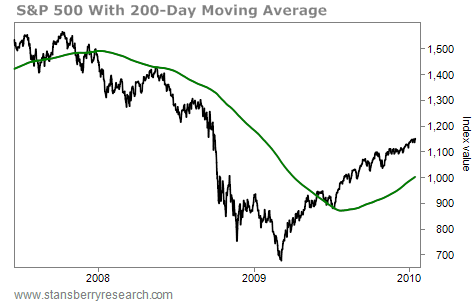

If you had sold back in 2007 when the stock market fell below the 200-day moving average, you would have gotten out near 1,500 on the stock market – and you would have missed the crash all the way down to 666. Take a look…

There’s nothing magical about the 200-day average – it’s just an objective measure to be able to say the uptrend is over, it’s time to get out.

Right now, we’re still in one of the “good” states of the market – expensive but in an uptrend. So according to Meb, it’s not time to worry – yet. But that time may be coming, soon.

Good investing,

Steve

P.S. I highly recommend that you check out our FREE Inside True Wealth podcast, available right here.

[ad#stansberry-ps]

Source: Daily Wealth