The latest issue of True Wealth Systems just came out…

The latest issue of True Wealth Systems just came out…

True Wealth Systems is a trading service that distills my decades of investing experience into more than three dozen computer models. And this month, our TWS computers told us we have new “buy” signals.

The first TWS buy signal was on a system that would have delivered a 400%-plus return in one trade from mid-2005 to early 2008. It is a “buy” again today.

[ad#Google Adsense 336×280-IA]The other “buy” signal was on Italy…

Italy?

I couldn’t believe it.

Who would touch Italian stocks today?

Ah, but that is just it… That is when you want to buy.

Let me explain…

I have to admit, I never would have come up with this idea in my normal course of business today. Italy is off my radar. But that’s just it… It’s off everyone’s radar.

The right time to buy to make the most profits is when EVERYONE has given up on an idea – INCLUDING me. And the right time to buy an investment is when it’s cheap and hated… but when a new uptrend is in place.

Italy offers all that, right now. Here’s what our TWS computers see…

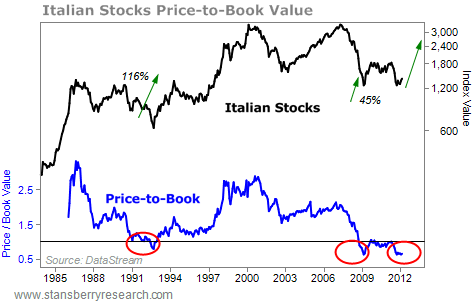

First, Italian stocks are cheap. In terms of “book value,” Italy is now one of the best values in history. Take a look…

Today, Italy trades for a price-to-book ratio of just 0.77. Remember, book value is a rough measure of liquidation value. So a price-to-book-value ratio of 0.77 equates to buying assets at a discount of about 23%… or buying $1 for $0.77!

Today, Italy trades for a price-to-book ratio of just 0.77. Remember, book value is a rough measure of liquidation value. So a price-to-book-value ratio of 0.77 equates to buying assets at a discount of about 23%… or buying $1 for $0.77!

Italian stocks have only been this cheap two other times – in late 1992 and in early 2009. Those buying opportunities led to 116% gains in 19 months and 45% returns in seven months, respectively.

It isn’t just book value. Italian stocks are cheap just about any way you look at them.

To understand just how cheap Italian stocks are today, take a look at how they compare to the rest of the world… As you can see, Italy trades for a big discount to its peers in every category.

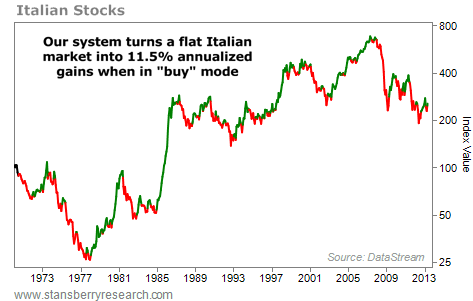

Historically, Italian stocks haven’t been the best investment. Italian stocks have gone nowhere in U.S. dollar terms since 1987.

Historically, Italian stocks haven’t been the best investment. Italian stocks have gone nowhere in U.S. dollar terms since 1987.

However, even with near-zero overall returns, our True Wealth Systems indicator is able to turn Italy into a winning investment.

We’ve tested our system going back over 40 years. Buying Italian stocks when our system says “buy” returns 11.5% a year. Take a look…

When the chart is green, our system is in the trade. You can see our system caught the big uptrends in Italian stocks. As of April 30, our system says Italian stocks are a “buy.” In addition, Italian stocks are dirt-cheap compared to history and compared to the rest of the world.

When the chart is green, our system is in the trade. You can see our system caught the big uptrends in Italian stocks. As of April 30, our system says Italian stocks are a “buy.” In addition, Italian stocks are dirt-cheap compared to history and compared to the rest of the world.

This is the exact setup I look for in an investment. Luckily, True Wealth Systems caught it… even though I didn’t see it.

You can easily buy Italian stocks with the iShares MSCI Italy Index (NYSE: EWI).

Today, Italian stocks are cheap, hated, and – as of April 30 – starting a new uptrend.

Based on history, we could easily see triple-digit gains over the next 12-24 months. And EWI is the easy way to make the trade.

Good investing,

Steve

Sponsored Link: As I mentioned earlier, this month’s other “buy” signal come from a system that would have delivered a 400%-plus return in one trade from mid-2005 to early 2008. I just published a full report detailing the opportunity for my True Wealth Systems readers. You can learn how to access this report – and all my research – right here.

Source: DailyWealth