In November, my True Wealth Systems computers said to buy steel stocks…

In November, my True Wealth Systems computers said to buy steel stocks…

Steel stocks? Who buys those anymore?

That’s what I thought, too… But then I realized my mistake…

You see, the exact moment that you want to consider buying an investment is when it’s completely off everyone’s radar. That’s when you have the potential for the biggest gains.

And that’s where steel stocks are today…

[ad#Google Adsense 336×280-IA]Steel stocks have been a losing trade for the last year and a half.

The sector crashed 42% from early 2011 to its November low.

The selloff can be attributed to China, the world’s largest consumer of steel.

China’s growth has been slowing (down from 12% annual growth in 2010 to 7.4% today)… and that’s bad for steel.

But my True Wealth Systems computers saw something else… They saw a dirt-cheap sector that investors had left for dead… and a downtrend that appeared to be ending.

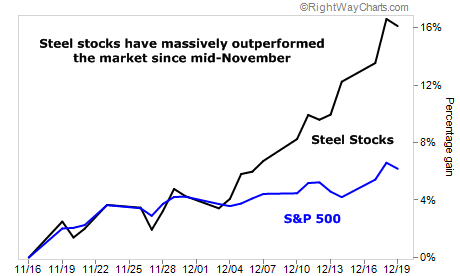

Astoundingly, our computers nailed it. Steel stocks are up over 16% from their November lows. By comparison, the S&P 500 is only up 6% during the same period.

And you haven’t missed the opportunity yet…

Twice in the last 25 years, our system has caught most of the two 750%-plus megatrends in steel while in buy mode. And we have a similar setup today.

Importantly, while our steel stocks system returns 22% a year in buy mode, it has returned an extraordinary 53% annualized during those two spectacular trades.

This could be the beginning of the next megatrend in steel stocks. Here’s why…

In short, investors hate steel. They want nothing to do with it – the same as they did right before the previous two megatrends.

Investors are fearful, so it’s time for us to be greedy. Remember, the biggest gains typically come when you’re able to buy an investment when it’s off everyone’s radar.

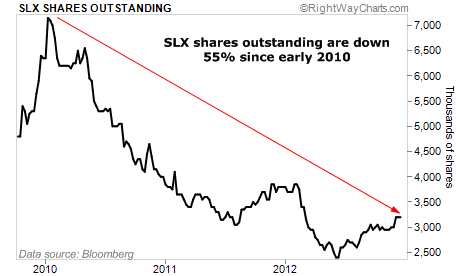

Investors have fled the steel sector in droves. The shares outstanding in the major steel exchange-traded fund – the Market Vectors Steel Fund (NYSEARCE: SLX) – are down 59% since 2010. Take a look…

When shares outstanding plummet, it shows investors are scared. They don’t want to own steel. They want out.

That’s why SLX’s shares outstanding are falling again… As I said, investing in steel has been a losing trade. Because of that, global steel companies are now trading for near-record-cheap prices.

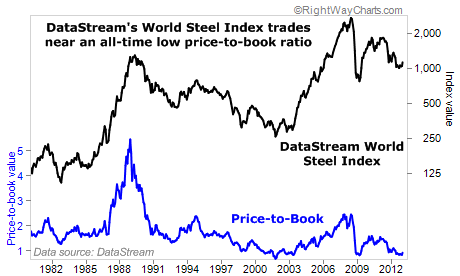

The chart below shows what I mean. It’s the DataStream World Steel Index versus its price-to-book ratio. Today, the World Steel Index is trading near all-time low levels…

As I write, the DataStream World Steel Index trades for just 0.85 times book value. Remember… book value is a rough measure of liquidation value, so buying at today’s price is similar to buying a dollar for 85 cents.

The easiest way to buy steel – SLX – is also cheap. It’s trading for 11.1 times next year’s estimated earnings. SLX needs to rise 24% just to reach the current forward price-to-earnings ratio of the overall stock market.

Buying steel companies is a bet on the global economy. The thing is, the economy doesn’t have to get all the way better… It just has to get “less bad.” But right now, investors are acting as if we’ll never need steel again.

This is exactly what I look for in an investment… It’s cheap, hated, and firmly in an uptrend. (Again, steel stocks are up 16% from their November lows).

Our upside is great. We could be at the beginning of the next 750% run in steel.

True Wealth Systems subscribers are already up in steel stocks. But this cheap-, hated-, and in-an-uptrend opportunity is likely just getting started… Check out SLX today.

Good investing,

Steve

[ad#stansberry-ps]

Source: DailyWealth