“We have a huge opportunity in front of us,” I told readers of my True Wealth Systems trading service in early October.

“We have a huge opportunity in front of us,” I told readers of my True Wealth Systems trading service in early October.

“Our Seven-Market Trader system is flashing ‘buy.'”

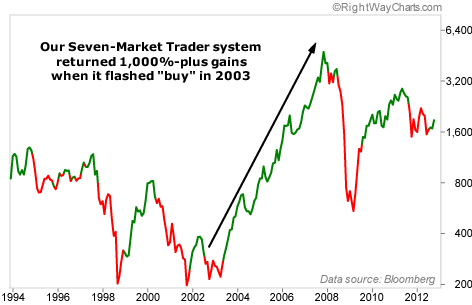

When it gave us a buy signal in 2003, it was good for a 1,000%-plus gain. And now, an opportunity is opening up to make similar gains again today.

Take a look at the chart below… When the line is green, our Seven-Market Trader system is in buy mode. And as the chart shows, it’s in buy mode again.

The Seven-Market Trader system is one of the many trading systems we use in my True Wealth Systems service. Unlike most computer-based trading systems, we like to keep ours simple…

[ad#Google Adsense 336×280-IA]This may surprise you, but we DO NOT actually set out to find the ultimate system that would have worked based on history… because we know that history doesn’t repeat itself exactly.

Instead, we come up with simple systems that make sense intuitively and work across a variety of different market situations.

Our Seven-Market Trader system shows you what I mean…

It looks at seven of the world’s major emerging-market stock markets: China, India, South Korea, Brazil, Mexico, Russia, and South Africa.

The range of possible scores for our system is “plus seven” to “minus seven.”

A “plus seven” score means each of these emerging-market countries hit a 12-month high in the most recent month. A “minus seven” score means each of them hit a 12-month low in the same period. (We only look at month-end data for these scores.)

If just one country hits a 12-month high and there are no new lows, the score that month is “plus one.” If three countries hit 12-month lows and just one hits a 12-month high, the score is “minus two.”

It’s pretty basic math. If the number is positive, you want to own emerging markets. If the number is negative, you want to be out of emerging markets.

And right now, emerging markets are flashing a major buy signal… As I explained to my True Wealth Systems subscribers…

Unlike U.S. stocks or gold, emerging-market stocks haven’t run up that much. They are still a great value. And… right now, emerging-market stocks are cheap, hated, and finally in an uptrend – the exact criteria I look for in an investment.

It’s usually hard to get all three at once… but we have them now in emerging markets. We have to take advantage of this opportunity!

[Federal Reserve Chairman] Ben Bernanke has promised to keep rates low through mid-2015, at least. So we could get three more years of gains out of the ‘Bernanke Asset Bubble.’ And our emerging markets trade could easily deliver triple-digit gains to you during that time. Heck, quadruple-digit gains happened very recently – from 2003 to 2007. And today’s setup is better than it was back then.

The Seven-Market Trader system is simple. But it’s effective…

Your wealth would have compounded at 28.5% annually while “in the trade” (when the line is green on the above chart) – and this system has been “in the trade” over 60% of the time since the early 1990s. (For context, a “buy and hold” strategy would have delivered just 4.3% compound annual gains.)

Those returns are based on our “double-long emerging markets index.” This is simply the daily percentage price change of the MSCI Emerging Markets Index multiplied by two. To make money from this system, we buy the ProShares Ultra MSCI Emerging Markets Fund (EET).

Since it’s a double-long fund, we could potentially see triple-digit gains in 12 months. A word of caution… These shares will be volatile. Anything with the potential for triple-digit returns also has the potential for you to lose REAL money. Emerging markets are volatile by nature, and a double-long fund doubles that volatility. EET returns twice the daily return of the MSCI Emerging Markets Index. So keep in mind… while up days will be twice as good, down days will be twice as bad.

Again, the basic idea is if more countries are closer to new highs than new lows, you’re in a bull market in emerging markets. So based on the Seven-Market Trader system, we’re in a bull market in emerging markets right now. It’s time to get onboard…

Good investing,

Steve

[ad#stansberry-ps]

Source: DailyWealth