I haven’t bought a stock in Italy in two decades.

I haven’t bought a stock in Italy in two decades.

Honestly, I’d given up on Italy… I’d put it “out of sight, out of mind.” I assumed I’d never invest there again.

But then I got a surprise on March 1…

Our True Wealth Systems computers say now is the best time in over 50 years to buy Italian stocks.

A buy signal? On Italy? Really?

Yes… something extraordinary is happening there… something that could lead to triple-digit gains in 18 months, based on history. And you can limit your downside risk to roughly 15% (the 2012 lows). I like those odds…

[ad#Google Adsense 336×280-IA]Today, Italian stocks are at the same level they were in 1986 – over a quarter-century ago – in U.S. dollar terms.

For comparison… during the same time, the Dow Jones Industrials Index has gone from below 2,000 to around 13,000.

So why have Italian stocks done nothing? Because Italy has done nothing to grow…

For example, the unemployment rate among young people (under age 25) in Italy is now an astonishing 31%.

The government makes it difficult for businesses to fire workers.

And if it’s difficult to fire someone, you’re less likely to hire someone.

Things are terrible in Italy. But we don’t need things to be great for us to make money…

All we need is for things to get “less bad” for a little while.

And that is happening right now in Italy… Thanks to Mario Monti…

Mario Monti is Italy’s new leader. He was not elected… He was asked to step in when the Prime Minister stepped down in November. He’s currently making major changes. And it turns out… the Italians – so far, at least – appreciate that he is trying to clean things up.

(Bloomberg News recently did an excellent two-minute video on what Monti is up to. It’s critical you watch it to understand what’s happening in Italy right now.)

Thanks to Monti, things are getting “less bad” in Italy (but nobody is paying attention). Italian stocks are record-cheap. And the uptrend has begun.

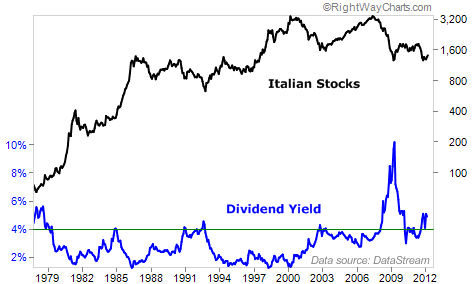

One way we gauge how cheap stocks are is their dividend yield. And right now, for the first time in over 30 years, Italian stocks are (legitimately) paying out near-5% dividends…

(I say “legitimately” because in 2009, the “official” dividend yield soared. But many companies ended up cutting their dividends. Investors didn’t get to pocket that high yield.)

In 1979, 1985, 1993, and 2003, the dividend yield hit the mid-4% range – and each time, Italian stocks soared soon after:

But this time around is much better…

You see, back in 1980 when the dividend yield hit 5% in Italy, inflation was running near 20%, and interest rates on government bonds were around 20%. With inflation near 20%, a 5% dividend was worthless. Inflation is closer to 2% today.

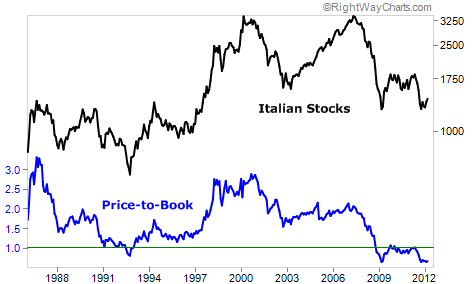

Another traditional measure of value is the price-to-book ratio. By both measures, Italy is as cheap as it’s been in nearly 20 years…

Unbelievably, as you can see above, Italian stocks trade at a significant discount to book value – the lowest ever in the 25 years of data we have. The story is similar on a price-to-earnings basis.

In both cases, Italy today is cheaper than it was in 1993 – the last time it was super-cheap. After bottoming back then, Italian stocks soared 116% in dollar terms in the following 19 months.

I expect we could see a triple-digit burst like that again…

Remember… things don’t have to get good in Italy. That’s not what we’re expecting. Things just have to get less bad. And they are… Interest rates, for example, have fallen dramatically since Monti arrived.

The stock market hasn’t soared… yet. But we do have a glimmer of an uptrend.

Based on risk versus potential reward, it’s worth “taking a shot at it.” The simplest way to play this idea is through the iShares Italy Fund (EWI).

I never would have even considered Italy if True Wealth Systems hadn’t alerted me to it… But True Wealth Systems is exactly right: Italy has all the ingredients – it’s cheap, hated, and has the start of an uptrend.

Good investing,

Steve

Sponsored Ad: “Steve Sjuggerud’s best idea ever…” That’s what his publisher called a recent investment idea of his from True Wealth Systems. For the story on that idea, click here.

Source: Daily Wealth