If there’s one thing I love, it’s picking up on a “sleeper” income opportunity that first-level investors have walked right past.

And today I’m going to show you not one but three. And one of these stealth buys yields a safe, stable 9.5%.

So a $100,000 investment in this unloved fund would hand you a nice $9,500 in 2018, or a steady $2,375 when its dividends drop into your account every quarter.

I’ll have more to say about these 3 funds—all of which are managed by a real, live human—shortly, including why they’re a better way to go than a “dumb” index fund.

But right now, I will reveal that all 3 of these funds are in the utilities sector, which has itself been a sleeping giant in 2017.

Even the “dumb” utility index fund, the Utilities Select Sector SPDR (XLU) has had a terrific year!

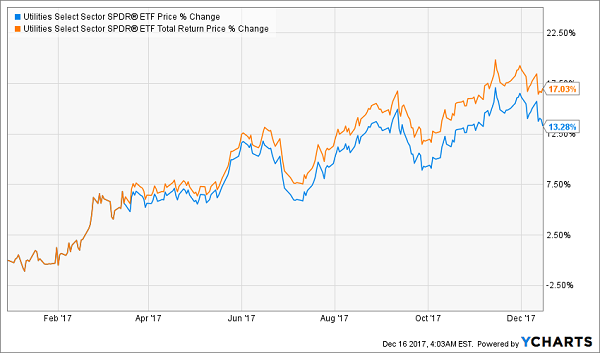

Utilities Pop in ’17

Note the two different numbers here. The blue line is XLU’s market price, or how much the price of a share has changed in 2017. The orange line is the total return price. As you can see, that’s a good 3.7 percentage points higher.

Why? Because a lot of XLU’s returns come in the form of dividends.

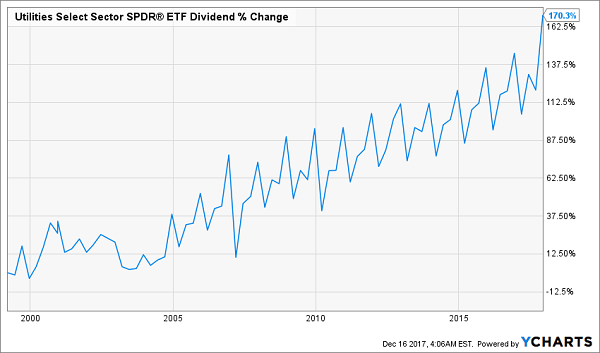

The fund’s 3.1% yield is high by today’s standards, but the nice thing is that utilities raise their payouts in the long run. That’s why XLU’s dividends did this in the last 20 years:

Payouts Keep Rising

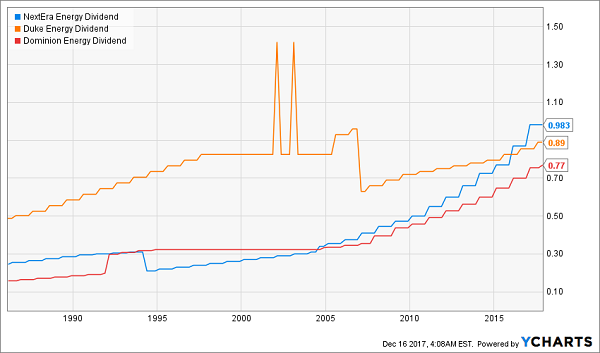

This soaring dividend is possible because the companies XLU holds keep raising their payouts to shareholders. Take a look at this chart showing the dividends of the 3 biggest utility firms in America: NextEra Energy (NEE), Duke Energy (DUK) and Dominion Energy (D):

Payouts Rise—But the Ride is Bumpy

Notice how Duke Energy’s dividend actually collapsed in the mid-2000s? This isn’t because of a crisis in the utilities industry. This was a case of mismanagement—and that’s why picking individual utilities is risky.

It also shows the drawbacks of investing in utilities through an index fund like XLU. Because Duke is such a massive utility, the fund had to include the company in its portfolio, even if XLU’s managers thought it might run into trouble.

Luckily, we’ve got a third option: the 3 actively managed, utility focused closed-end funds (CEFs) I’ll show you now. Each one has an experienced pro (or team of pros) at the helm, giving us a much better chance of avoiding dividend disasters. (If you’re unfamiliar with CEFs, click here for a complete primer on these high-yield investments.)

Better yet, we can get a much bigger income stream, like the fund I mentioned off the top that pays 9.5% now (it’s pick No. 3 below).

So without further ado, here are the 3 funds that should be on your list if you’re looking to add some utility exposure to your portfolio.

Fund #1: Big Total Returns and a Nice Discount

The first fund to consider is the Reaves Utility Income Fund (UTG).

This fund holds a ton of utilities and is well run, with a 9.6% annualized total return over the last decade, the best of all utility-focused CEFs. Plus, UTG pays a 6.1% dividend yield—a solid cash stream that’s nearly double what XLU gives us.

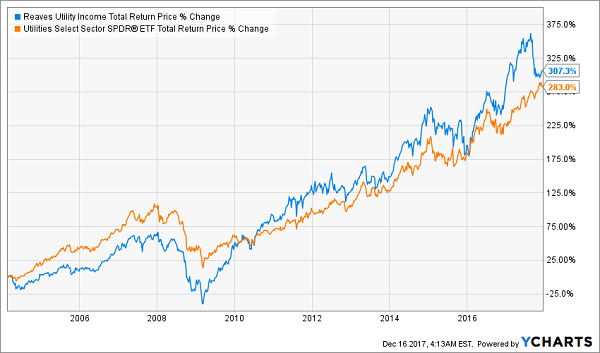

The best part? UTG has crushed the index:

Beating the Dumb Money

This strong outperformance shows UTG’s managers are more than earning their 1.7% fees (the returns of this fund, and all funds I show you, are after fees are paid out). That makes it a good fund to consider for utilities exposure.

Fund #2: Strong Returns on Sale

I wrote about the Cohen & Steers Infrastructure Fund (UTF) back on November 24, and since then shareholders have gotten a couple of treats. The first is the special dividend that shareholders are going to get at the end of the year, which boosts the fund’s forward yield to a juicy 8.8%! Despite those generous payouts, UTF has grown its net asset value (NAV, or what its underlying portfolio is worth) by 24.1% in 2017 on a total-return basis, far more than XLU’s 17% NAV gains for the same period.

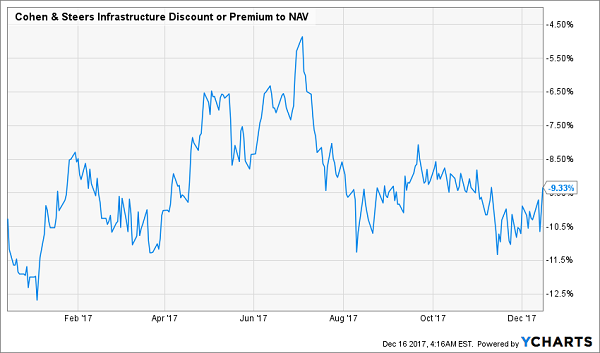

UTF is also undervalued, with a market price that’s 9.3% lower than its NAV—but the fund traded at half that discount just a few months ago:

A Buy Window for UTF

A 20% capital gain isn’t out of the question for this fund in 2018, on top of its healthy income stream. That definitely makes UTF a utility CEF to consider now.

Fund #3: Bet on World Growth and Get 9.5% Income

Finally, let’s take a look at that fund I mentioned off the top—the one that pays out a 9.5% dividend yield. It also trades at a nice 4.8% discount to its NAV.

Why so cheap?

One reason, and one reason only: the market is stuck in the past. This fund, the Macquarie/First Global Infrastructure Fund (MFD), has had lackluster returns in the last few years due to the US dollar. The income from its investments is sound, but the US dollar had been getting stronger, which meant the foreign currency–based income MFD earns has been worth less and less in US-dollar terms.

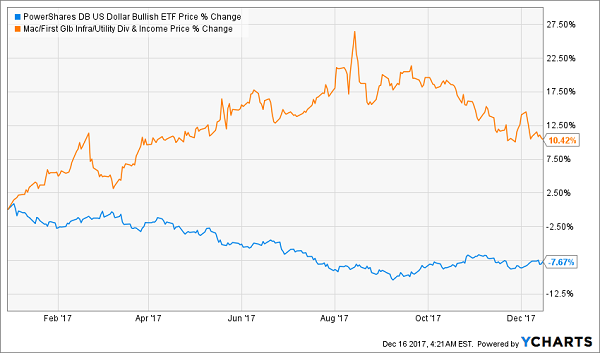

Now take a look at this:

Weaker Dollar, Stronger Gains

The recent weakness in the US dollar has helped MFD’s income strengthen throughout 2017, and that’s resulted in more money flowing into the fund. But the weakness in the greenback isn’t over, which means MFD’s income stream is going to get stronger.

How do I know the US dollar isn’t poised for a turnaround?

Simple: the government said so.

Not only has President Trump said he supports a weaker US dollar, but the Federal Reserve has repeatedly said it wants to encourage more risk-taking investment in the American economy.

That means the Fed wants companies to take the dollars they’re sitting on and put them to use through building, investing and hiring. This lowers demand for the greenback, as we’ve seen throughout 2017. Expect this trend to continue—and expect MFD to benefit.

— Michael Foster

4 More “Sleeper Hits” With Dividends Up to 10.4% [sponsor]

Just a couple weeks ago, I released a fully updated FREE Special Report on my 4 favorite funds for 2018—and I made one last-minute addition I think you’ll love.

It’s a totally ignored CEF that boasts an incredible (and easily sustainable) 10.4% dividend payout! So a $100,000 investment would hand us a safe $10,400 a year in dividend payouts—or $2,600 every quarter!

Just imagine what that could do for your retirement.

There’s more: this unsung CEF is ridiculously undervalued—I’m talking about a 5.3% discount to NAV here. That doesn’t sound like much until you realize that this fund usually trades at a 1.7% premium.

That simply means we’ve got a nice gain already baked in when that “normal” premium returns—as it’s already starting to do!

That’s to say nothing about the “bonus” upside this 10.4%-paying income titan has, thanks to its other secret weapon: its top-notch management team.

In short, this crew has an eye for bargains unlike any I’ve ever seen: this CEF’s portfolio is made up of a basket of stocks with an average P/E ratio of 17.5—way lower than the S&P 500’s nosebleed 25!

Add it all up, and this unsung fund is lined up for EASY 20% price gains “on the side” in 2018. And I’ll say it again: we’ll still be collecting that 10.4% income stream along the way!

I’ll show you the name, ticker and everything I have on this incredible fund when you CLICK HERE. I’ll also reveal the names of my 3 other favorite CEFs, too. Add these 4 powerhouse funds together and you get an “instant” portfolio spread across just about every asset class you can think of: US stocks, foreign stocks, bonds, real estate and more.

PLUS, these 4 income powerhouses combine to hand you a safe—and GROWING—8.1% average dividend yield and easy 20%+ upside next year.

But I must warn you: The outrageous discounts on all 4 of these “perfect” investments are starting to vanish, so you need to act now. CLICK HERE to get the names, tickers and everything you need to know about my 4 top CEF buys for 2018 NOW.

Source: Contrarian Outlook