We’ve spent a lot of time this year talking about how to maximize your investment returns with good reason – many of the dynamic companies and investment opportunities we talk about frequently have been on an absolute tear in 2017.

Just to name a few…

…Boeing’s up 95.69%

…Facebook’s up 55.55%

…Apple’s up 47.9% year to date as I write

…Alphabet’s up 34.81%

As great as that is, there’s something else we need to talk about – making money doesn’t mean squat if you can’t keep it.

Most investors underestimate how important this is – if they think about it at all.

I find that sad because it means they’re working hard for their money, instead of their money working hard for them!

The irony, of course, is extreme.

You see, the overwhelming majority of investors tend to plan for everything – except for success.

My guess is that they never had to.

The average life expectancy at the time of the American Revolution was a whopping 23 years. By 1900 it was 47. Today that’s 84, and with some babies born this year, even living to 150 could be a reality!

And if you’re already of a certain vintage like I am, the same thinking applies – even though it’s very tempting to dismiss it.

The average 70-year-old today will likely live to their late 80s. Somebody in their late 80s now may live into their mid-90s. Reaching 2050 is not only possible for some folks, but likely.

Ergo, tracking the world’s best investments is only half the equation. Keeping the big profits you bank is more important than it’s ever been because the last thing you want to do is run out of money before you run out of life.

Here are five Total Wealth Tactics that will set you up for a great 2018… And, hopefully, many years to come.

- The right investments in the right accounts.

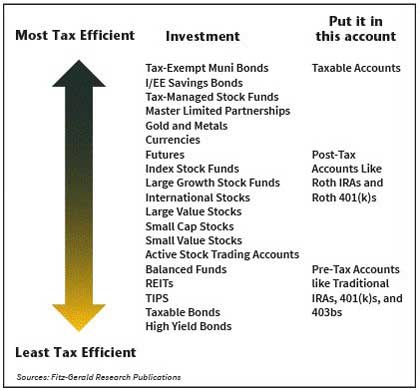

Generally speaking, there is a continuum:

a. Taxable accounts: These include your plain vanilla individual or joint investment account, bank accounts, and money market mutual funds.

b. Post-Tax accounts: Roth IRAs and 401(k)s fall into this category.

c. Pre-Tax Accounts: Think of Traditional IRAs, 401(k)s and 403(b)s.

I’ve created the following chart to help you sort them out and arranged them in declining order from the most to the least tax efficient.

Obviously, your financial situation is unique, so there’s a little wiggle room here. That’s why there are no firm dividing lines in my chart.

Obviously, your financial situation is unique, so there’s a little wiggle room here. That’s why there are no firm dividing lines in my chart.

2.Lose money selectively.

Normally, I hate taking losses, but doing so can really pay when it comes to letting go of some of your underperformers at a loss – right now.

That’s because the IRS allows you to use capital losses as a way to offset realized capital gains. You can even carry $3,000 in losses forward for use at a future date. Incidentally, I think that’s one of the very few sensible IRS regulations there are.

3. Redirect your winners.

The best way to do that is to redirect profits into investments that have not performed as well as you’d like. I’m not talking about the dogs (which you want to sell as part of losing money selectively) – I’m talking about taking advantage of the market’s natural ebbs and flows to dollar cost average into companies you still believe in as a means of lowering your cost basis and boosting your returns.

4. Time your investments, not the markets.

What I mean by this is that, whenever possible, you want to hold your stocks for at least 12 months. That way you’ll qualify for more favorable long-term tax treatment than you would if you sold inside of a year.

I realize that this is getting harder as the markets get choppier and government policy wonks want to get their hands on your money to make up for their own fiscal incompetence, but that doesn’t invalidate the thinking.

It’s worth noting, by the way, that this is a very important consideration in and of itself because you can combine this knowledge with some of our favorite Total Wealth Risk Management Tactics including stop-losses, trailing stops, dollar cost averaging, and even rebalancing.

The key thought here is, generally speaking, the faster you sell, the higher your tax liability is.

5. Batten down the hatches and sharpen your pencil.

This year has been truly fabulous for savvy investors like you who are part of the Total Wealth Family and who have tapped into the Unstoppable Trends we follow.

The S&P 500 has tacked on a staggering 17.8% while the Dow now sits at 24,754 – both of which you will recall I told you to prepare for in our January 2017 Outlook.

Now, though, it makes sense to shore things up a bit.

To be clear, I’m not expecting the bull market to end any time soon – I’ll have more on that in our January 2018 update shortly. I am simply expecting traders to take a year-end breather.

Typically, that means stocks with high PE ratios are going to come under short-term pressure – think big tech, financials and even health care here.

The best way to prepare for that is twofold:

- Take a moment now – ahead of the holidays – to make sure you’ve got trailing stops in place for all over your investments so that they’ll withstand any short-term holiday volatility; and,

- Get your buy list ready. Specifically, I want to see you make a list of every stock you’d like to own when the price is right but don’t yet have in your portfolio. Many investors, for example, have missed out on the tech run and would give anything to have Amazon at $1,177 a share or Alphabet at $1,070 – when both are “on sale.”

As always, I want you to talk to your favorite tax professional or accountant.

That way you can tailor today’s column to your specific individual investment circumstances, objectives and risk tolerance.

Then, get ready for a GREAT 2018!

I am more excited than I’ve been in a long time by what I see happening in the world around us – at least when it comes to the most exciting investment opportunities I can find.

Global growth is big, but corporate profits are on track to be even bigger.

Best regards and Merry Christmas,

Keith Fitz-Gerald

[ad#mmpress]

Source: Total Wealth Research