About one month ago, President Donald Trump was outside Harrisburg, Pennsylvania vowing to end America’s so-called “death tax.”

The “death tax” is a common name for the estate tax.

The IRS claims that it’s “a tax on your right to transfer property at your death.”

That’s right… after decades of paying taxes, the IRS can take even more after you die, taking that money away from your spouse and heirs.

When you die, the federal government taxes a portion of your estate.

The tax rate can be as high as 40%.

But no matter what happens with the death tax, we have a way to shield nearly $11 million from the IRS’ death tax right now…

Now, I know what you’re thinking. Our current administration vows to cut the federal estate tax, so why write about it?

The thing is, we’ve heard this talk before. That’s why I’ll remind you again: You can’t trust the government to take care of you. You need to understand your own situation and learn as much as you can so you can control what happens to your estate.

An estate consists of your cash, real estate, investments, and other assets. This is what the government taxes when you pass.

The federal estate tax affects everyone. But the following 14 states and Washington, D.C. also impose a separate estate tax…

If you live in Connecticut, Delaware, Hawaii, Illinois, Maine, Maryland, Massachusetts, Minnesota, New Jersey, New York, Oregon, Rhode Island, Vermont, or Washington, you face additional estate taxes.

Some of these states set the same exemption limit as the federal government. However, a few are much lower… New Jersey is the lowest, with the limit at just $675,000. Meanwhile, several other states are moving to increase their exemption limits.

On top of that, Hawaii offers a helpful process that allows spouses to effectively double their exemption. Although other states haven’t followed suit yet, it’s already available in federal estate taxes.

You see, federal law allows you to transfer estate exemptions between spouses. This process is called portability…

Say that Jack and Nancy are married. With a nice family farm, a vacation home, and hefty portfolios, their estate value is $9 million. Then, Jack passes away.

The 2017 estate tax exemption limit is $5.49 million. But if all the assets are in both their names (as joint owners), the estate passes to Nancy without triggering any tax.

When Nancy dies, her heirs can claim her individual estate tax exemption of $5.49 million. The rest of the estate faces the estate tax rate. The top rate is 40%, but most estates pay less than that. That’s because the rate falls into levels based on gross estate value.

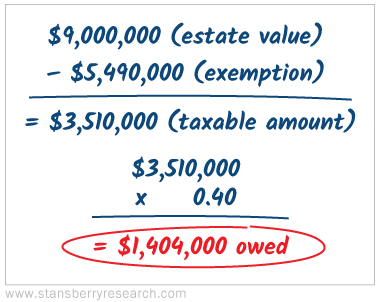

In the case of Jack and Nancy, their gross estate value is large enough that it faces the 40% tax. However, the tax is only levied on the excess over the exemption limit.

So that’s:

That means Jack and Nancy are paying more than $1,000,000 for the “privilege” of dying in America. Think about that. That’s a lot to take away from their children and grandchildren.

That means Jack and Nancy are paying more than $1,000,000 for the “privilege” of dying in America. Think about that. That’s a lot to take away from their children and grandchildren.

However, if Nancy knows to file for what’s called a “portability election,” she can take her exemption plus Jack’s unused portion.

That would increase her exemption to $10,980,000… more than enough to cover their $9 million estate. Which means that estate is passed on to her family free from the federal estate tax.

But this doesn’t happen automatically. Nancy would have to file IRS Form 706 to take over the remainder of Jack’s unused exemption. It’s called the United States Estate (and Generation-Skipping Transfer) Tax Return. And here’s the key: You must file this form within nine months of your spouse’s death.

There’s also another way to increase the amount of your death-tax exemption, even if all your assets aren’t owned jointly…

Say most of the assets are in Nancy’s name, but Jack has a few solely in his name (and therefore would not qualify for the automatic transfer to his spouse). When he dies, his estate is only worth $4 million. That estate would be exempt from estate tax. However, Nancy could file for the remaining portion… the $1.49 million still in his exemption. That way, if her estate increases to more than $5.49 million, she’ll have that additional coverage available.

And more recent news: If your spouse died after 2010, you now have until January 2 to file a portability claim. This is thanks to a simplified process from the IRS… It effectively eliminates the nine-month rule, but only if you act now.

It allows you to file form 706 retroactively… Just write “Filed Pursuant to Rev. Proc. 2017-34 to Elect Portability Under Section §2010(c)(5)(A)” at the top of the first page.

Remember, all this only deals with federal estate taxes. State taxes differ… And some states also impose an inheritance tax on top of an estate tax. But this is a good place to start… so you can pass on your hard-earned wealth to your heirs and loved ones.

Here’s to our health, wealth, and a great retirement,

Dr. David Eifrig

[ad#stansberry-ps]

Source: Daily Wealth