At the height of the dot-com bubble, the Lycos search engine was worth about $240 per eyeball.

About 20 years ago, Internet evangelists argued that profits or even revenue no longer mattered… They created alternative valuations to measure Internet stocks, including the number of “eyeballs” they could attract.

Tech stocks soared. Bulls argued, “This time it’s different.”

Of course, we know it wasn’t. Profits still mattered.

And the tech darlings came crashing down – bringing the rest of the market with them.

Today, Lycos is worth practically nothing.

“This time it’s different” has become a pejorative phrase.

It’s used by value-investing adherents to tag those willing to buy stocks at anything higher than a reasonable valuation.

So with stocks on the rise… is it different this time?

The problem here is that in the truest sense, every time is different. Circumstances always change… But the basics of human behavior don’t change. Markets get overheated as investors fear missing out on returns. They’ll always drift too far upward and then too far downward, eventually reverting to the mean.

However, if your argument is that the mean doesn’t change, you’re too stubborn…

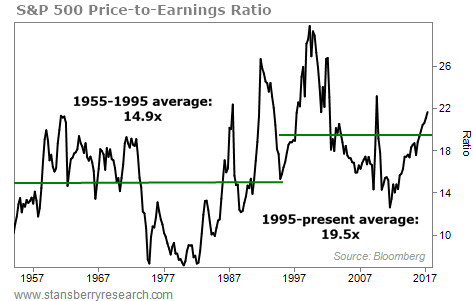

The new average is higher. The days of the market trading at 12 times and 15 times average earnings are gone…

Some hardline value investors have anchored to the price-to-earnings ratios of the 1970s and 1980s. But valuations have fundamentally stretched since then…

This may not last. However, we believe some things are unquestionably different this time. If we focus on what we know, we see that several factors are working together to lift the market today…

This may not last. However, we believe some things are unquestionably different this time. If we focus on what we know, we see that several factors are working together to lift the market today…

First, as we explained in a recent essay, growing earnings have ticked markets up over the last few months in what looks like the start of a strong upcycle in revenue growth. But there’s more to the story…

You see, mountains of investment capital continue to chase historically low rates.

We’ve argued this point for years now. Other prognosticators claimed that on the day the Federal Reserve raised rates, bonds would collapse… wiping out the savings of millions.

Well, the Fed has raised rates four times now. And while bonds have fluctuated a bit, yields and prices are within spitting distance of where they started.

Now, the Federal Reserve is planning to reduce its balance sheet by reducing mortgage-backed security holdings and Treasury holdings. The totals are expected to be between $4 billion and $20 billion a month (though likely at the lower end).

The bond market is unperturbed.

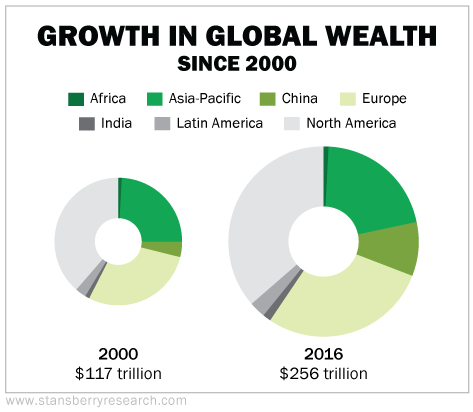

The issue at hand is the massive accumulation of global wealth. We simply didn’t have as much capital in the world as recently as a decade ago. While the U.S. has long been wealthy, now the world is growing wealthier, too.

In 2016 alone, global wealth grew by $3.5 trillion to total $256 trillion.

Since the turn of the century, China has quadrupled its wealth. India has tripled. Even developed economies in Europe and North America have more than doubled their total wealth.

Over the last two decades, economic growth has exploded. And trade – be it between two people or two nations – is not a zero-sum game. It creates value out of “thin air.” That value has been piling up and getting siphoned into both safe assets like Treasury securities and risky assets like stocks.

Over the last two decades, economic growth has exploded. And trade – be it between two people or two nations – is not a zero-sum game. It creates value out of “thin air.” That value has been piling up and getting siphoned into both safe assets like Treasury securities and risky assets like stocks.

That’s why rates stay low. The Fed’s $4 billion to $20 billion of buying per month doesn’t even qualify as a drop in the bucket… It’s a single water molecule.

That growing global economy – paired with the scale of technology – also expands the capabilities for companies to capture huge markets that didn’t exist before. Companies like Alphabet (GOOGL) and Facebook (FB) can serve billions of people. With a bigger market, the gains to the winner become larger than ever.

In sum, the Fed’s moves don’t matter. Economies and earnings are growing. And that’s driving markets up.

We think that valuations are high, but nowhere near bubble territory. There’s no euphoria in markets. There’s no mania chasing prices to astronomical levels. Today, we simply see a rising market.

And we don’t expect that to change until cracks show in the underlying economies of the biggest nations.

Here’s to our health, wealth, and a great retirement,

Dr. David Eifrig

[ad#stansberry-ps]

Source: Daily Wealth