The first time I heard the term Industry 4.0 was in 2011 when Germany launched its ‘Industrie 4.0’ project. Today, other names such as the Fourth Industrial Revolution and the Industrial Internet of Things (IIoT) are also used to talk about the same thing.

But what is it exactly?

Fourth Industrial Revolution

The best description I can give for the IIoT is that it is the convergence of two worlds – information technology (IT) and operational technology (OT) – that have always been disconnected. In other words, it’s a bridge between the digital and the physical, creating cyber-physical manufacturing systems.

This Fourth Industrial Revolution involves a whole host of technologies. Among the technologies included are:

- additive manufacturing

- advanced robotics and cobots

- augmented reality

- autonomous production

- cloud computing

- data collection and analysis

- machine vision

- sophisticated sensors

- virtual reality and cyber-security

Why you as an investor should be so excited about this (as I am) is that we are in the very early innings of this convergence between IT & OT.

That means there are lots of profits to be had from investing in a number of companies involved in this convergence.

Great Opportunity for Profit

The epicenter of this industrial revolution, at the moment, is occurring in the manufacturing, transport and energy sectors.

The falling costs of sensors, advanced communications, data storage and analytics have made it easy to record and process lots of information about physical systems from factory assembly lines to trains and planes to oil rigs to wind turbines.

This new reality can be seen in data from research firm Gartner.

It says there were 2.4 billion connected devices used by businesses in 2016.

That number will grow to 3.1 billion this year and then to more than double to 7.6 billion connected devices by 2020.

What this means is obvious.

What this means is obvious.

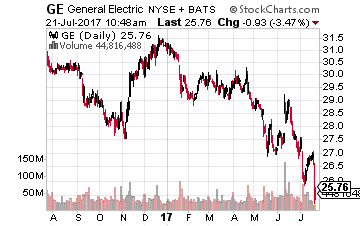

Bill Ruh, chief digital officer for General Electric (NYSE: GE), told the Financial Times “It [IIoT] is a huge opportunity for all industrial companies.

Data analytics and machine connectivity are the way to get to the next level of productivity.”

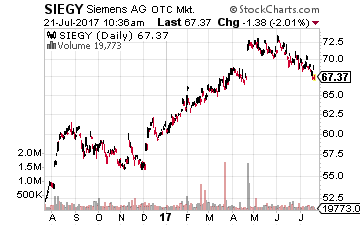

But as the chief technology officer at German industrial powerhouse Siemens (OTC: SIEGY), Roland Busch, warns “there will be winners and losers.”

Especially when one considers there were 360 companies offering IoT platforms last year, according to IOT Analytics.

That’s why I’m working on a major research project to find for you the very best opportunities from the Fourth Industrial Revolution. Stay tuned for updates from me on this project.

That’s why I’m working on a major research project to find for you the very best opportunities from the Fourth Industrial Revolution. Stay tuned for updates from me on this project.

Industrial Juggernauts

One key to finding tomorrow’s winners is to see which industrial companies are bulking up their digital skills and technologies.

So far, the big boys – GE and Siemens – are following the right game plan. GE plans to become a top 10 software company by the end of the decade. It already has 14,000 software engineers and plans to add 6,000 more staff for its digital operations. Meanwhile, Siemens has spent $15 billion since 2007 on U.S. software companies and has 21,000 software engineers.

These companies know they have to invest now for a payoff in the future. GE, for example, says its digital business will not make a noticeable contribution to earnings until 2019-20.

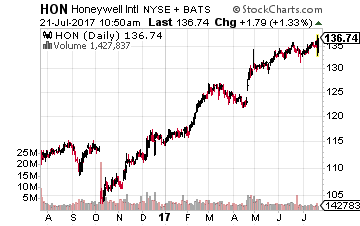

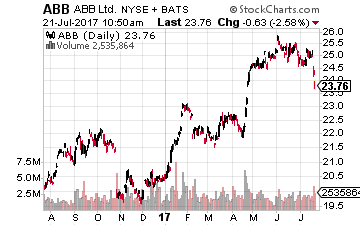

Of course, other industrial juggernauts like Honeywell (NYSE: HON) and ABB Ltd (NYSE: ABB) are also transforming their companies into digital ones.

Of course, other industrial juggernauts like Honeywell (NYSE: HON) and ABB Ltd (NYSE: ABB) are also transforming their companies into digital ones.

An investment into any of these four industrial giants should prove profitable in the years ahead.

An Interesting ETF

But keep in mind that Industry 4.0 will move out away from its industrial base. Already smart agriculture, smart transportation, and logistics, smart oil & gas, smart healthcare, smart electric grid, smart cities, etc. are on the horizon.

With that in mind, an interesting way to play the broad theme of Industry 4.0 is through the Global X Internet of Things ETF (Nasdaq: SNSR). This ETF’s portfolio, as of July 18, consisted of 45 stocks (60% U.S. companies) across a broad range of industries.

With that in mind, an interesting way to play the broad theme of Industry 4.0 is through the Global X Internet of Things ETF (Nasdaq: SNSR). This ETF’s portfolio, as of July 18, consisted of 45 stocks (60% U.S. companies) across a broad range of industries.

However, the portfolio does not include the aforementioned industrial powerhouses.

Instead, among its top 10 positions are the likes of STMicroelectronics NV (NYSE: STM), Skyworks Solutions (Nasdaq: SWKS) and Sensata Technologies Holding NV (NYSE: ST).

The approximate major sector breakdown for the fund is as follows:

- Semiconductors – 38.5%

- Electrical Components & Equipment – 15.1%

- Communications Equipment – 10.9%

- Application Software – 6.6%

- Consumer Electronics – 5.5%

- Healthcare Equipment – 4.9%

- Technology Hardware – 3.7%

- Electronic Components – 3.6%

The fund charges a 0.68% annual management fee.

A good idea may be to combine with this ETF with one or more of the big industrial companies in your portfolio. This could be one of the greatest investing opportunities of the next decade, and just like many other technological revolutions, there will be huge winners but also massive losers.

— Tony Daltorio

[ad#ia-tim]

Source: Investors Alley