People I don’t know – complete strangers, actually – are asking me to loan them money. This is not peer-to-peer lending or a GoFundMe project.

It’s legit and, frankly, quite exciting. These are successful movie directors and restaurant owners… theater companies and craft distilleries.

[ad#Google Adsense 336×280-IA]In return, they’re offering me a percentage of their revenue.

It reminds me of when I was financing various projects in Southeast Asia. On any given day, I’d get a dozen proposals… from gold mines to housing projects.

Once I moved back to the U.S. and began investing in privately owned shares, I thought I’d never see those days again.

These deals are called “revenue sharing” or “revenue participation.” You can find them on the internet, if you know where to look. (More on that in a minute.)

Basically, they come in two flavors.

Some are capped. When you get back your loan, plus whatever amount was promised above that, the deal is done.

Some are uncapped. Your interest income keeps coming until revenues dry up.

I know what you’re thinking… Why in the world would a company participate in revenue sharing?

The truth is that banks barely loan to small businesses at all anymore.

This is why new “lenders” like Kabbage.com are making a killing with 24% to 99% APRs on loans to small businesses.

Revenue sharing gives startups an easier – more affordable – way to fund their operations.

Let me show you three deals going on right now to give you an idea of how they work…

Bunny Bravo. Instead of taking your kids or grandkids to see this animated film, you can invest in it. Bunny Bravo is produced by Mychal Simka and features well-known stars. The English version stars Cheri Oteri (former Saturday Night Live cast member), Jason Mewes (half of the Jay and Silent Bob duo) and Alexa PenaVega (from the Spy Kids series). The Spanish cast is equally star-studded.

By the way, Simka’s last English/Spanish pair of films made more than $9 million at the domestic box office.

The revenue-sharing terms? Simka promises to pay investors from 100% of “adjusted gross proceeds” until they make 125%. Thereafter, the revenue is split 50-50 (between investors and producers)… until it eventually peters out.

These terms are standard in the movie industry. Not that you should know something like this. After all, this is the first time EVER that this kind of deal is being offered to EVERYBODY… under crowdfunding rules.

This deal is uncapped. The risks? Same for all movies. Will it be a flop? Will it be a hit? Will it land somewhere in between?

If it’s a flop? It’s direct to DVD, and the company still makes back a big chunk of its raise (which should be anywhere from $200K to $700K).

What I like about this deal is that the revenue share kicks in IMMEDIATELY. And, let’s be clear here, this is revenue, not profit. Investors get paid first.

(Editor’s Note: There is some fine print on what constitutes “adjusted gross proceeds.” Be sure to read it if you’re considering an investment.)

And the money is going into a finished product. The movie is already made. The money from the raise will fund the movie’s rollout to the public.

OK, here’s some quick math on what happens if this movie pulls in $9 million – same as Simka’s last dual-language film.

Let’s say it raises its maximum amount. Then the first $700K of revenues (current maximum raise plus two previous $100K investments) will pay investors the full amount of their loan. The next $175K will pay them the additional 25% promised.

Half of the remaining $8 million goes to the investors. Investors make 5.8 times the amount they loaned.

If it raises its minimum amount? Investors then make 10 times their money.

The reality is that there’s no guarantee that this movie will do as well (or nearly as well). And it’s Simka’s first time producing and distributing a movie outside the studio system. Investors might not even get their principal back, if things go sideways.

The deal is available on the widely respected MicroVentures site. The minimum investment is only $100. Click here to see more of the details.

What are MicroVentures and Wefunder?

MicroVentures and Wefunder are Regulation Crowdfunding Portals (Reg CF Portals). Enabled by the JOBS Act of 2012, they allow startups and small businesses to raise money from their customers, friends, partners and new investors. They can raise money in the form of equity, revenue share agreements or at a fixed rate.

Napa Valley Distillery (NVD). Family owned and operated, NVD produces more than a dozen small-batch and limited-release spirits – including the award-winning Meyer Lemon Liqueur and Napa Vodka.

It also operates a bar club, and it plans to build a full kitchen and operate a small restaurant in its main location. That would allow it to serve cocktails, beer and wine any time of day and begin a new cocktail and food pairing service.

NVD is offering investors 10% of the company’s revenue until they make their principal back, plus 50%.

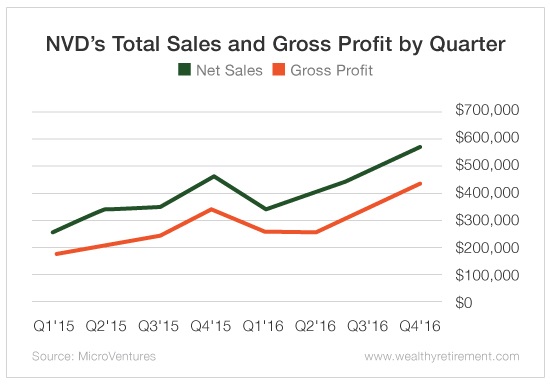

The risk is completely different from the Bunny Bravo deal. This is no flop vs. hit proposition. NVD’s business is well-established, and profits and revenue are growing…

Last year, it made $1.8 million in sales. With the money it gets from its raise, it hopes to make much more.

But let’s take a worse-case scenario – that sales go flat at $2 million a year. It would pay back investors at a rate of $200K annually. If NVD raises its maximum amount ($1.07 million), it would take five years to pay investors back their principal and another 2.5 years to pay them their additional 50%.

That’s a 5.5% compound interest rate – as a worse-case scenario, remember.

OK, here’s a more realistic scenario. NVD raises $300K – current amount raised is $105K – and its revenue increases to an average of $3 million over the next three years.

Investors would then get their principal back in one year. It would take another six months to receive their 50% promised gain. Investors in this scenario would make 28% (in compound interest) for a relatively low-risk loan.

The two main risks – that the company could go out of business or see its revenues collapse – are extremely unlikely.

NVD’s deal is live on the MicroVentures site. Check it out here.

The Speakeasy. It’s San Francisco’s immersive theater experience that recreates a Prohibition-era saloon. Its 2014 production sold out 75 consecutive shows and became profitable in just four months.

Now the Speakeasy is back, after upgrading and expanding its venue to three times the square footage.

The deal terms? Make 100% on top of your principal by grabbing 2% of the annual revenue.

The company hopes to make $3 million to $3.5 million a year. Two percent of that comes to between $60K and $70K.

Depending on how much the production company raises – it’s targeting $200K to $550K – investors will get the full amount of their loan back anywhere from within three years (with the minimum raised) to within eight or nine years (with the maximum raised).

To get their next 100%, double those years.

The annual interest ranges between 4% (if the maximum is raised) and 12% (if the minimum is raised).

The risks? The company’s revenue projections. They could be slightly to way off. If revenue comes in lower than expected – especially much lower – then investors could be disappointed with the returns.

The Speakeasy deal is live on Wefunder. Visit the site right here for more details.

My 10 Takeaways for Revenue Sharing

- Capped deals tend to be safer, but have lower upside than uncapped deals.

- The key metric is revenue, not profit. This makes it very different from equity investments, where profit matters. After all, companies operating at huge losses usually disappoint their shareholders.

- If you’re an early-stage investor, you’ll see a cash return IMMEDIATELY. Instead of waiting years, you’ll be waiting months.

- Where else can you make double-digit annual interest income? The upside can be exceptional.

- Risk varies greatly from deal to deal.

- You have enough details about these deals to assess risk and come to an informed decision.

- There are deals where risk is minimal and realistic annual returns start at double digits.

- You invest with two X factors: future revenue and amount of money raised. The less guessing you do with these two numbers, the more predictable your future returns will be.

- As these kinds of deals increase in number (which is a certainty), you will be able to choose the risk and reward profile that suits you best.

- You should identify the anomaly. The more risky the deal, the higher the promised return should be. So look for not-so-risky deals with generous revenue-sharing terms.

Invest early and well,

Andy

[ad#agora]

Source: Wealthy Retirement