Listen to this warning…

The next financial crisis won’t be like any other you’ve ever seen.

It won’t just hit the commercial banks. It will hit the central banks. And there’s no one to bail them out.

This is a fact…

The Swiss central bank owns more shares of Facebook than Mark Zuckerberg, the company’s founder.

[ad#Google Adsense 336×280-IA]That means when the world’s wealthiest, most conservative, and most risk-averse investors open a Swiss bank account to hold the world’s best currency – the Swiss franc – they’re really buying U.S. stocks.

In 2016 alone, the Swiss central bank ownership of global equities grew by 41%.

The Swiss central bank now owns almost $500 billion worth of equities in markets around the world.

That makes it one of the 10 largest investors in the entire world – a tiny country of just over 8 million people.

The U.S. stock market is approaching an all-time high level of valuation. Only the ’29 bubble and the 2000 tech bubble saw the S&P 500 Index trade at a higher multiple of earnings. (Stocks are now trading at 25 times last year’s GAAP earnings.)

Stocks are now essentially more expensive than they’ve ever been before.

And who is buying at these levels? Central banks.

Central banks began buying stocks because they virtually ran out of bonds to buy. Said another way, once they bought so many bonds that interest rates fell to zero, they simply couldn’t buy any more. To continue their “free money” policies, they had to continue to expand their balance sheets. They’ve done so by buying massive quantities of stocks, all around the world. For example, the Japanese central bank now owns more than 10% of every single company in the Nikkei index and is the largest owner of more than 55 different companies.

The central banks’ move into equities is even more dangerous than most people realize.

You see, they’ve funneled their buying into indexes to minimize the costs. As a result, the majority of these tremendous inflows have been channeled into the 10 largest stocks that trade in the U.S.: Apple (AAPL), Alphabet (GOOGL), Microsoft (MSFT), Amazon (AMZN), Facebook (FB), Berkshire Hathaway (BRK-A), ExxonMobil (XOM), Johnson & Johnson (JNJ), JPMorgan (JPM), and Alibaba (BABA).

These shares are up around 30% over the past year, compared with around 15% for the S&P 500 as a whole.

So… the central banks aren’t merely buying at the top… They’re concentrating their investments and following an investment strategy that’s completely mindless.

What could possibly go wrong?

The world seems to have forgotten that currencies are supposed to be unchanging units of measurement.

It’s critical to a healthy economy to have a sound currency that’s NOT volatile. The key to generating investment capital (which is necessary to grow productivity and wealth) is a fair playing field, where the rules and values aren’t always changing.

Over the past few years, the volatility of currencies has soared. Today, bitcoin is less volatile than the British pound. Does that sound normal to you?

The soaring volatility of currencies, along with the diminishing volatility of the world’s stock markets, is a direct result of the central banks’ equity buying. As long as the central banks supply a never-ending “bid” for stocks and continue to stuff their balance sheets full of financial securities, the world’s traders are going to treat their currencies like stock index funds – because that’s what they’ve become.

Central banks’ free-money policies have now permanently linked the value of every currency in the world to value of the stock market.

As a result, governments have turned the global economy and the value of every currency in the world into ticking time bombs.

The next panic in the stock market won’t merely hurt stock investors.

The next panic will hurt every human being on the planet… because every currency in the world is now tied to stock and bond prices.

The central banks haven’t merely wrecked the world’s currencies… They’ve warped our political systems, too. Although it’s probably hard to believe, these changes are the most dangerous aspects of what’s happening right now.

But… I don’t want today’s essay to be completely theoretical…

These big, macro themes have important, near-term implications…

The most critical one to understand right now is how the free-money policies have led to a huge bubble in corporate credit.

A virtual tidal wave of corporate debt is coming due over the next three years.

This pile of debt is lower-rated overall and contains more “junk” issuance than any other corporate-debt cycle in history. When I talk about how commodity prices and the credit structures that surround commodity production are the weak link in the central bankers’ free-money policies… I’m talking about the coming huge defaults in corporate credit.

With default rates already hitting 5%, it seems clear to most corporate-debt analysts that this default cycle is going to be a “doozy,” with losses for investors approaching 40% of junk issuance, at least.

That’s $1.5 trillion to $2 trillion in potential losses in the next four years.

Recently, my colleague and DailyWealth analyst Brett Eversole wrote about the same topic. However, Brett looks at the markets from a completely different perspective. My work is “bottom up.” I’m looking at the detailed fundamentals of each issuer and each type of debt that’s outstanding. Our corporate-credit database includes information on more than 40,000 individual credits.

Brett, on the other hand, looks at the dynamics of the entire market, not individual issuers. What he sees is that credit spreads (the premium investors earn to hold risky debt) are far too low for this stage of the credit cycle. His advice is to sell all of your high-yield bonds, right now. If you haven’t seen his work, I’d recommend looking at it closely.

I’ve been writing about these risks to subscribers of my Stansberry’s Credit Opportunities newsletter for months. Looking at the corporate-credit market at the individual-issuer level, we’ve watched all of the good opportunities disappear.

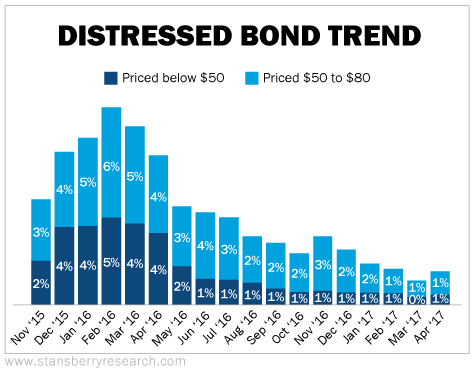

The following chart shows you the percentage of distressed, high-yield bonds that are trading at significant discounts. The dark blue bars indicate what percentage of the market is trading at a deeply discounted price (below 50% of par) and the light blue shows you the percentage trading at a substantial discount (50%-80% of par – that is, a 20%-50% discount).

In the first few months after we launched Stansberry’s Credit Opportunities, around 11% of the market was trading at a substantial discount or more. Today, it’s just 1%.

So, is today a great time to buy distressed corporate debt? No, absolutely not. Does that mean the strategy doesn’t ever work? No, absolutely not.

So, is today a great time to buy distressed corporate debt? No, absolutely not. Does that mean the strategy doesn’t ever work? No, absolutely not.

Our job as investment analysts is to stand at the plate and look at the pitches. We can’t control what the pitcher throws. We can only decide when we’re going to swing. But the cool part of this game is that there are no “called” strikes. There’s no penalty for not swinging.

That ability, to sit tight, hold cash, and ignore everything except for the “fat pitch” right over the plate is something that most investors never learn. But I hope you will.

You can bet that at some point in the next four years, the risk spread on junk bonds will “blow out” again to 10% or more. When that happens, we’ll start pounding the table on buying carefully selected distressed corporate credit. These bonds will be trading for $0.80 on the dollar (or less) and yielding 15% a year or more. These are great investments that can provide unbelievable returns, with almost no risk.

We made a slew of these recommendations during the 2009-2010 default cycle. We did it in 2015 and 2016, when defaults first spiked off their cyclical lows too. I’m 100% certain we’ll be there for our subscribers when it’s time to put capital to work in this asset class.

Until then, we’ve just got to keep watching the pitches.

Good investing,

Porter Stansberry

[ad#stansberry-ps]

Source: Daily Wealth