We’ve got some gold investment advice that flies in the face of one popular myth about gold prices. The myth is that the price of gold can’t rise over the long term when interest rates are steadily climbing. But that’s just not true…

With the U.S. Federal Reserve saying that it will likely be raising interest rates three times this year and several times in 2018, the United States is definitely in a period of increasing rates. This has investors worried about safe-haven investments like gold.

But our gold investing advice is to not be scared away from the gold sector during hawkish interest rate eras. You see, physical gold and gold mining stocks could be highly profitable as interest rates rise over the long term.

In fact, we predict gold prices could rise as much as 10.8% to $1,400 this year, even if we see three more rate hikes…

Why You Should Follow Our Gold Investment Advice

You see, the gold price myth that the metal and interest rates can’t rise in tandem stems from gold’s relationship to the U.S. dollar.

[ad#Google Adsense 336×280-IA]Gold and the dollar historically trade inversely.

Since the metal is priced in dollars, a rising dollar lowers the price of gold.

That’s because gold becomes more expensive to users of other currencies.

Rising interest rates typically boost the dollar, which is why investors are led to believe periods of climbing rates are bearish for gold prices.

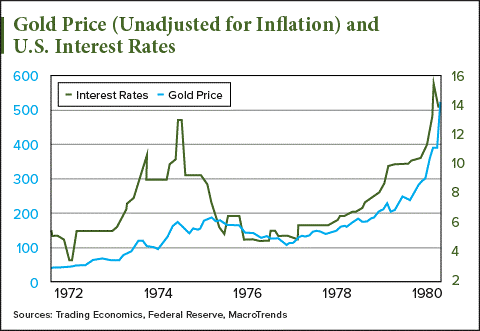

But Money Morning Resource Specialist Peter Krauth says all you have to do is look back to the 1970s to debunk this popular gold myth.

For most of that decade, interest rates were consistently above 5%. That’s much higher than current interest rates, which stand in the 0.75% to 1% range after the most recent March rate hike.

But rates started skyrocketing as the decade wore on. In fact, if you look at this chart, you’ll see they reached a high of 15% by 1979 before falling as the 1980s recession started to emerge.

Meanwhile, the price of gold saw incredible growth during the decade. From January 1970 to January 1980, the metal exploded from $34.83 to over $500 (unadjusted for inflation).

Meanwhile, the price of gold saw incredible growth during the decade. From January 1970 to January 1980, the metal exploded from $34.83 to over $500 (unadjusted for inflation).

The decade serves as a sort of myth buster: gold prices can rally alongside rising interest rates.

And we may be repeating history as the gold price and interest rates continue higher over the long term. The Federal Reserve has hiked rates three times since Dec. 16, 2015. Data from FactSet shows that gold has climbed 17.5% from $1,077 to the current price of $1,264 over that period. And Krauth expects it to rally another 10.8% to $1,400 by the end of 2017.

Gold’s strong long-term performance shows how the metal can rally despite a backdrop of climbing interest rates. That’s why the best gold investment advice we can give you is to keep your money in the gold sector for the foreseeable future.

If you’re looking to enter the gold sector, we recommend investing in gold mining stocks. As gold prices continue to rise during this hawkish rate environment, these miners will be set for strong profit growth. After all, higher prices only mean they’ll make more money on each ounce of gold they produce.

And this gold mining stock could surge as much as 58.8% in the next year…

The Best Gold Stock to Buy in 2017 for a 58.8% Return

Goldcorp Inc. (NYSE: GG) is our top gold stock recommendation and one of Money Morning Executive Editor Bill Patalon’s favorite investments.

With 10 active mines across Canada, Mexico, and South America, Goldcorp is one of the largest gold miners in the world. It’s also one of the most efficient miners in the world, with a low all-in sustaining cost (AISC) of $812. That means it only costs the company $812 in operating costs to produce one ounce of gold.

When the price of gold hits Krauth’s forecast $1,400 level by the end of the year, Goldcorp’s profit margin would reach 40%. That’s an impressive rate by any standard.

But Patalon – an investment analyst with over 22 years of experience – loves GG stock because of the firm’s reputation as a leading innovator in the sector, which stems mostly from a highly successful experiment…

In March 2000, it experimented in crowdsourcing with what became known as the “Goldcorp challenge.” The company opened its gold mining database to the public, inviting it to pick and choose the best possible sites for a gold mine.

The experiment was an unexpected success. People not only responded, but they also responded correctly. Roughly 80% of the selected sites had significant deposits of gold.

Right now, shares of GG stock trade for $13.85 per share. But analysts surveyed by Yahoo Finance give GG a one-year target of $22. That’s a strong return of 58.8% in just 12 months.

Goldcorp’s efficiency and reputation in the mining sector make it one of the best gold investments of 2017.

— Money Morning Staff

[ad#mmpress]

Source: Money Morning