United Parcel Service Inc. (UPS) currently offers a dividend yield in excess of 3%. Moreover, it is also available at a valuation that is slightly below historical norms. The company has provided a stable and growing dividend since it went public in 1999.

[ad#Google Adsense 336×280-IA]However, the company did keep their dividend the same for fiscal years 2001 and 2002, but they did not cut it. Additionally, 2008 included five dividend payments due to a change in their dividend payment schedule.

Nevertheless, their dividend growth rate since 1999 has averaged 13% per annum, but the dividend growth rate has slowed somewhat to 8.2% per annum since 2013.

United Parcel Service Inc. carries an A+ credit rating from S&P but does have a debt to capital ratio of 75% – which I consider a concern.

However, the company generates significant revenues and produces ample cash flows to service and eventually retire its debt.

Moreover, a significant portion of their debt is long-term, which does moderately alleviate my concerns.

But more importantly, the debt they have recently taken on was used to fund numerous acquisitions since 2014 and to expand international services significantly. I see the latter as a huge opportunity that should bear fruit over the longer run.

United Parcel Service Inc.: Meeting Specific Well-Defined Objectives

A lot of people take a rather simplistic view of investing. To their way of thinking, investing is always about where they think they can make the most money. However, attempting to make maximum returns often comes with taking on excessive levels of risk. The old adage “no risk no gain” seems to be their mantra.

To these people, a common objective is: am I beating the market and by how much? However, I see the investing process as much more nuanced.

Just like apparel, investments come in all shapes, sizes and colors. Some are conservative – and maybe even boring or drab. Others are very flashy, colorful and even risqué. Each will appeal to a different personality type. There are some people who would not be caught dead in flashy clothing, and others that would wear nothing else. To this extent, it’s a matter of taste. Nevertheless, the pertinent element is to be comfortable with your choice.

Being comfortable with your choices is critically important as it relates to investments, especially common stock investments. The key is to choose investments that are capable of meeting your unique goals, objectives and risk tolerances. In all honesty, there was a time when maximum growth was my primary goal.

Therefore, I looked for stocks that I believed presented the best opportunity to grow my capital at above-average rates. I recognized the risk associated, and also understood that the fastest-growing companies rarely offered a dividend.

However, my goals and objectives have changed significantly in more recent years. Today, I am more concerned with preservation of capital, and more focused on having my investments supplement my income. Consequently, my personal focus has turned more towards dividend growth stocks than to pure non-dividend paying growth stocks.

Additionally, I consider each dividend payment as much a return of my capital as it is a return on my capital. In other words, with each installment of dividends I consider that my total capital at risk is essentially reduced.

Furthermore, my current investment objectives are even more focused than just choosing a different type of equity. I also have specific income objectives in mind as well. However, my income objectives are not arbitrary.

Instead, they are based on what I consider realistic assessments of what level of income is prudently available from high-quality dividend growth stocks. Moreover, my objectives are not solely about current yield. I also insist on what I call growth yield. In other words, I am specifically looking for dividend growth stocks that I am confident will provide me an increase in income with each passing year.

But perhaps most importantly, these income objectives are clearly measurable, and not subject to stock price volatility. My dividends are paid on the amount of shares I own, and once purchased, that number is fixed. Therefore, instead of worrying about how much the price of my stock has gone up or down today, I am solely focused on what the dividend per share is and whether it will increase or not in time.

I find this to be a very calming influence. Instead of worrying about the market, I take great pleasure and even comfort in depositing those dividend checks as they come in each quarter.

At the present time, given the realities of interest rate levels, my specific yield targets are well defined. Currently, I am looking for conservative stocks with a current yield of 3% or better. However, I would tend to eschew most stocks that offered current yields significantly above 5% due to the associated risk. On the other hand, I might sparingly include a few higher-yielding REITs in my overall portfolio.

This also gives the opportunity to blend a faster growing but lower growing dividend growth stock into the mix. This blending would allow me to hit my 3% current yield target while simultaneously providing some additional growth of capital.

Investment thesis: UPS

UPS is clearly the 800 pound gorilla of the global parcel shipment business. The company has established a worldwide infrastructure distribution network and they continue to invest heavily to expand their international presence. According to Morningstar, UPS invests $1 billion per year in IT which represents almost a 3rd of its capital expenditure budget.

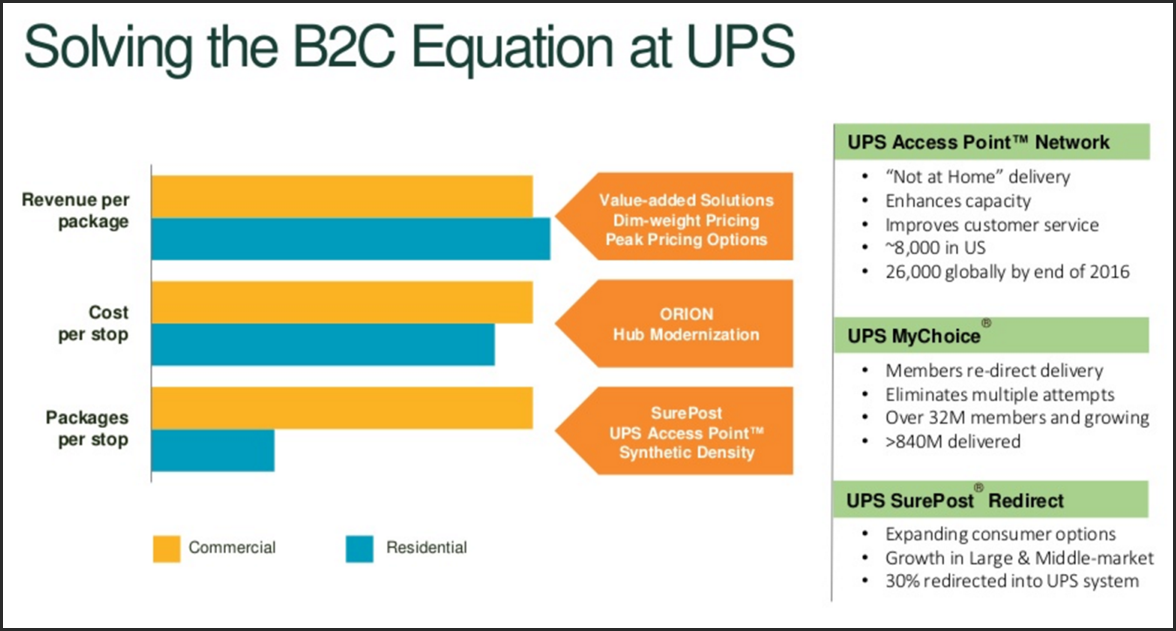

This is important because of the growing demand of B2C (business to consumer) which offers lower margins and greater distribution challenges than B2B (business to business) shipments. However, UPS is keenly aware of both the challenges and the opportunities from B2C deliveries. The following slide from their most recent presentation illustrates their awareness as well as their efforts towards a solution:

Part of the reason I bring this up is because there are many investors that are concerned that Amazon may be a disruptor longer-term. However, I believe those concerns are overblown. Amazon may develop their own internal distribution network, but I do not believe they are willing or capable of duplicating UPS’s massive worldwide distribution network and infrastructure.

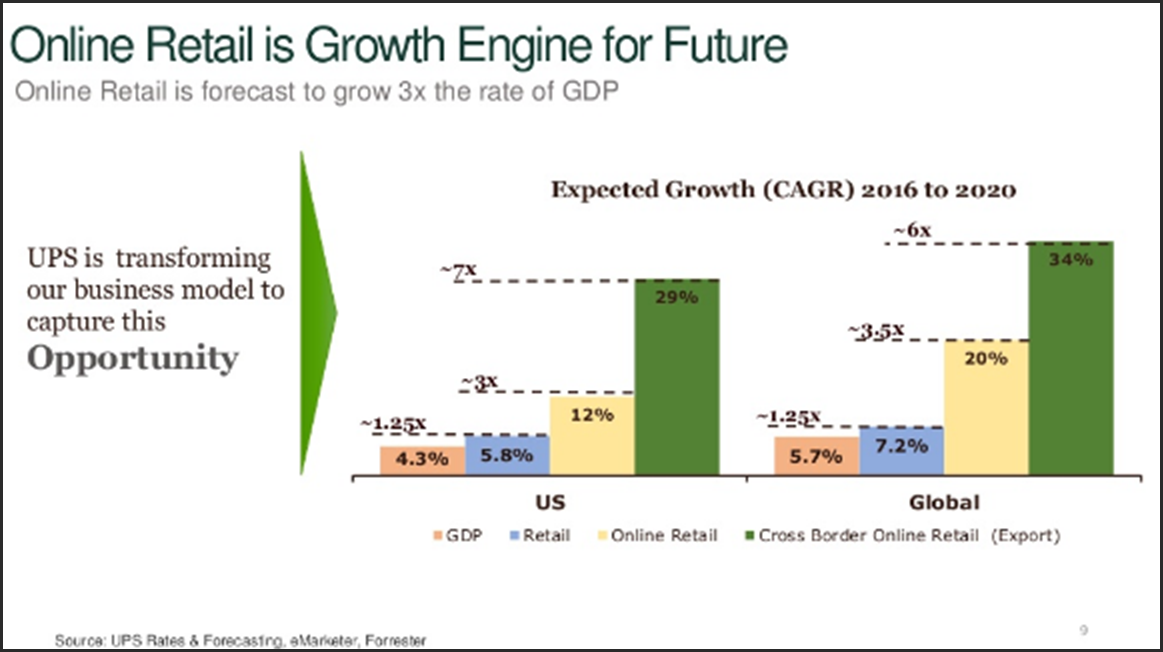

Moreover, there are thousands of large businesses and millions of small ones that will continue to utilize UPS and its competitors. More importantly, UPS believes that online retail is the growth engine of the future and they are transforming their business model to capture their fair share this opportunity as indicated below:

Additional evidence of their recognition of this opportunity as well as their strategy to capture their fair share is their announced implementation of Saturday ground service to half the US in 2017. This is forecast to boost their asset utilization and capacity. However, it will also require additional investment on their part.

Morningstar also awards UPS a wide moat based on their scale, cost advantages and large network. Morningstar contends that replicating UPS’s assets would be beyond the capacity of any competitor. This also contributes to Morningstar’s belief that UPS will out-earn its cost of capital over the next decade and possibly beyond. Consequently, Morningstar awards UPS the widest Moat in the transportation universe.

In addition to what’s been mentioned so far, UPS is also expanding their international footprint. UPS is already truly a global powerhouse in the worldwide package delivery business and they are expanding as evidenced by the following slide from their recent presentation:

Although UPS faces formidable competition from FedEx and others, the company earns higher margins than any of its peers. This is partially attributed to their scale and the efficiency of their operations. UPS also earns returns on invested capital that are double its cost of capital, which is indicative of their extensive technology investments referenced above. UPS has also invested in several acquisitions and strategic partnerships since 2014 creating synergistic opportunities and entrance into growing markets:

One of their more noteworthy acquisitions has been Coyote Logistics in 2015. Here is how Alan Gershenhorn, UPS Chief Commercial Officer described the opportunity from the acquisition:

“We are focused on expanding our capabilities… leveraging technology… and looking for opportunities that Network UPS for Growth. Coyote Logistics fits those objectives perfectly… They are one of the largest pure-play truckload brokerage firms… providing us an entrance into a fast growing marketplace. And on top of that UPS brings unique synergies to the table. These are the key points why this is a great deal for Investors… customers…Coyote…and for UPS.”

From there Mr. Gershenhorn went on to describe the scope of the opportunity and how it complements and extends UPS capabilities:

“The total US truckload industry is very large, topping 700 billion dollars in 2014. Within this huge market, truckload brokerage is estimated at 54 billion, and that’s 60 percent larger than the US LTL industry… and it’s growing at 7 percent per year. Historically, this has been a very fragmented market with an estimated 10,000 brokers. But, recently however, the industry has seen consolidation with several players building scale and eclipsing $1 billion dollars in revenue. Truckload brokerage is a natural adjacency to the more traditional small package & LTL markets that we currently participate in. Adding a truckload broker will clearly bring a significant capability to the UPS portfolio, while also extending the breadth of our ground transportation service from mail… to package… to LTL… and to now full-truckload.”

In November 2016 UPS also acquired privately held Marken, a global provider of supply chain solutions, to the life sciences industry. This acquisition adds to their broad array of specialized services for healthcare and life sciences. According to UPS, with this acquisition they now have more than 100 healthcare dedicated facilities with 60 GMP compliant (good manufacturing practice promulgated under the authority of the FDA) locations strategically positioned within global markets.

There is much more to the UPS growth story, but suffice it to say that I believe the company is poised for continued steady long-term future growth. But most importantly as it relates to my rationale for purchase, this should lead to a steady increase in their dividend over time as well.

UPS: F.A.S.T. Graphs™ Fundamental Analysis

The following video takes a deeper look at the fundamentals underpinning UPS. In the video I look at earnings, dividends, free cash flow, and other important fundamental metrics. Furthermore, I also provide my specific views of the rate of return opportunity that I believe UPS offers at current levels:

Summary and Conclusions

I believe that UPS offers the dividend growth investor an attractive high quality investment opportunity with an above-average current dividend yield. My biggest caveat is the valuation. Although the company is currently available at a blended P/E ratio that is modestly below historical norms, it is still moderately high relative to the company’s growth achievement. However, since the company went public in 1999, the market has traditionally awarded UPS a premium valuation. The company’s current valuation is slightly below these historical norms.

Finding high quality dividend growth stocks with above-average current yields has become very difficult. However, I believe UPS does offer the dividend growth investor the opportunity for a growing dividend yield with only modest downside risk. Furthermore, although the company has not outperformed the S&P 500 on a total return basis in recent years, it has produced greater cumulative total dividend income. On the other hand, considering the currently higher-than-normal valuation of the S&P 500, this may change going forward. Consequently, I believe that as it currently sits, UPS provides the opportunity to outperform the S&P 500 on both a capital appreciation and total dividend income basis over the next several years.

— Chuck Carnevale

[ad#wyatt-income]

Source: FAST Graphs