For many folks, getting the mail has become boring. The mailbox is routinely full of junk and bills.

But some savvy investors look forward to getting the mail…

[ad#Google Adsense 336×280-IA]Every month, their mailboxes are full of dividend checks.

The road to dividend “mailbox money” isn’t a short one, but it’s within reach for any disciplined investor willing to commit to a solid strategy for building future wealth.

If you want to build a portfolio of healthy dividend income streams, you’ll want to buy stocks that pay out according to different schedules.

That way, you can generate income for today – in addition to cash you’ll reinvest for the future.

Reinvesting your dividends means funneling your payouts back into the stock and buying more shares. More shares means bigger dividend checks in the future.

Most companies pay dividends quarterly. Others write checks just once a year.

But some stocks pay dividends monthly.

And these companies provide a frequent, predictable and steady source of income. Plus, when you reinvest those monthly dividends, you can take advantage of faster compounding.

One of the most well-known stocks that cuts investors a monthly dividend check is commercial REIT Realty Income Corporation (NYSE: O). It’s so proud of its monthly dividend commitment to investors that it has even trademarked itself “The Monthly Dividend Company.”

Marc’s Oxford Income Letter portfolios also include monthly dividend payers.

And when he wrote about one of those stocks a few weeks ago, he likened its monthly payout to “stepping on the gas of your compounding machine.” Here’s why…

Sometimes Less Is More

When companies pay quarterly dividends, investors get the chance to reinvest them four times a year.

But when a company pays its dividend monthly, the compounding process speeds up.

Investors will receive smaller payments more often. But they’ll also get to reinvest those dividend payments 12 times each year.

So, by routinely reinvesting, they end up with more shares and more income down the road.

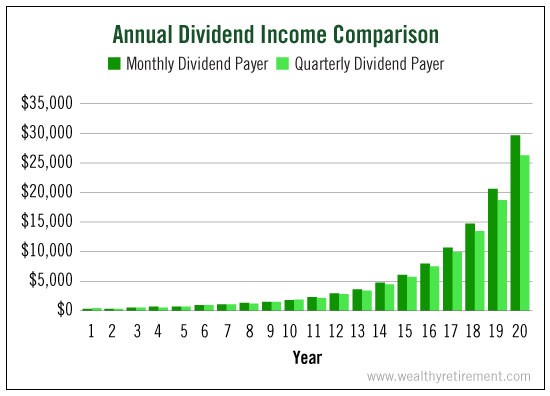

Let’s compare the reinvested dividends of a quarterly payer versus a monthly payer. For this example, we’ll assume a $10,000 initial investment in each stock with reinvested dividends for 20 years.

Both stocks are trading at $10 per share. Let’s say they have a 4% yield, and their dividends will each grow 10% each year.

One pays a quarterly dividend, and the other pays its dividend monthly.

In 20 years, the monthly payer will generate more than $3,000 more in annual dividend income than the quarterly one.

And because you’ll end up owning more shares, the value of your investment in the monthly dividend-paying stock will be $9,371 higher, too.

By choosing to reinvest the dividends of some of the stocks in your income portfolio, you’ll have more money tomorrow. And the more often you receive dividends, the faster those dividends can be reinvested.

The more shares you have, the more dividend income you will continue to generate. It’s that simple!

A Dividend Bonus… Not a Requirement

Of course, frequency of dividend payments isn’t the only factor to consider when choosing a dividend stock. It’s more of a bonus.

Dividend growth and coverage are more important. And free cash flow is key.

In his best-selling book Get Rich With Dividends, Marc teaches investors how to assess all of these metrics and select top dividend payers that fit with his 10-11-12 System to benefit from the power of compounding.

The 10-11-12 System is designed to help investors achieve 11% yields in 10 years or 12% average annual total returns when dividends are reinvested.

To reach this goal, Marc looks for “Perpetual Dividend Raisers.” These stocks have histories of raising their dividends every year. That way, the yields and returns outpace inflation.

When a company raises its dividend, your cost basis remains the same. So your yield on your cost basis goes higher.

You can find Perpetual Dividend Raisers across a variety of industries. However, there are just a few industries where you are most likely to find monthly payers. Many REITs, business development companies and closed-end funds distribute dividends to shareholders every 30 days.

Obviously, you should never buy a dividend stock based solely on its payment schedule. But when you do find a quality company that cuts checks monthly, consider it a welcome perk.

If you don’t need the income today, monthly reinvestment can help you take advantage of the power of compounding faster.

And collecting bigger dividends more frequently will lead you to a more valuable investment tomorrow.

Good investing,

Kristin

[ad#wyatt-income]

Source: Wealthy Retirement