It’s my least favorite time of year – tax season.

And if you’re like 70% of filers, last year, you overpaid your tax bill… again.

[ad#Google Adsense 336×280-IA]Personally, I hate thinking about all of the money I’ve “loaned” Uncle Sam interest-free over the years.

I say “loan” because that’s essentially what it is when you overpay your taxes.

Most people don’t mind because they receive their money back in the form of a “refund.”

You may feel good about getting a big chunk of change back from the IRS. I don’t.

That’s because a refund check costs more than you realize…

Since Uncle Sam took more of your income than he should have, it wasn’t available for you to invest.

If that money had been invested in the S&P 500 last year, you’d have made nearly 12% more than the refund check you’re going to receive.

Remember, the IRS doesn’t pay you interest on the amount you overpay.

On the flipside, if you underestimate what you owe, the IRS will be sure to tack on interest, penalties and other late fees.

Don’t you just love double standards?

Fortunately, there is a way to use your refund check to capture some of that unpaid interest today.

And, even better, it will start compounding tax-free.

Deposit a Deduction

You can arrange for the IRS to deposit your refund directly into a retirement account.

And when you do, you’ll save hundreds or even thousands on this year’s or next year’s tax bill.

To show you how it works, allow me to introduce my imaginary friend, Henry Wisenheimer. Henry is an average taxpaying citizen.

Last year, he made $50,000. He has to pay taxes on all of it, and his tax rate is 25%.

So he owes the IRS $12,500.

But Henry, like most of us, overpaid Uncle Sam. So he gets a refund.

His refund check is $2,857. (The average tax filer received $2,857 back from Uncle Sam in 2015.)

Last year, Henry didn’t contribute to his IRA. So he directs his entire refund check into his account.

His 2016 taxable income is now $47,143. His tax bill is $11,786.

Henry shaved $714 off his 2016 tax bill simply by depositing his refund check into his IRA.

And since he never had the money in his checking account in the first place, he won’t miss it.

I call this strategy a “refund contribution plan.” It’s a painless way to save for retirement. And the mechanics are simpler than you might imagine.

A Simple Setup to Reduce Taxes While Saving for Retirement

It’s easy to deposit your refund directly into an IRA.

All you need is the plan sponsor’s routing number and your IRA account number. If you don’t know the information, ask your IRA administrator.

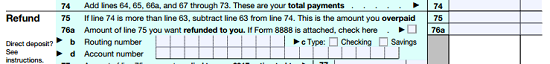

If you’re contributing the whole amount, all you need to do is fill out the first two lines in the refund section on IRS Form 1040 or Form 1040A.

If you want to apply your refund to multiple accounts, you can use IRS Form 8888, called “Allocation of Refund,” to split your refund across as many as three accounts.

Just make sure to fill in the Form 8888 box on your tax return (1040 or 1040A).

Remember, if you apply your 2016 refund to last year’s taxable income, your IRA administrator must receive the funds by April 18. File early to make sure your refund meets the deadline.

Alternatively, if you have the cash available, contribute now. Then you can pay yourself back when you get your refund. (You may need to contact your IRA administrator after the deposit to designate it as a 2016 contribution.)

Nobody enjoys paying taxes, but this way allows you to pay yourself handsomely for loaning money to Uncle Sam.

By depositing your refund into your IRA, you can save money on your tax bill – all while contributing, tax-free, to your retirement.

It’s enough to almost make you love tax season.

Plus, it allows you to turn that double standard into a double benefit!

Good investing,

Kristin

[ad#agora]

Source: Wealthy Retirement