Fifty years ago, going to college was the exception, not the norm.

Very few professions required a college degree outside of the medical or legal fields.

[ad#Google Adsense 336×280-IA]Instead of heading to college, most high school graduates entered the workforce immediately.

Many found positions as apprentices.

They found a career on the job. Not in a classroom.

My grandfather was one of them. After high school, he entered an apprenticeship program.

And he eventually retired from a successful career as a mechanical engineer.

But the career path for many of today’s high school graduates looks a lot different from my grandfather’s. It requires an expensive four-year detour and tens or even hundreds of thousands of dollars in college bills.

Too many parents and their children aren’t prepared to pay for college. So grandparents are stepping up to help foot the bill.

As many as 39% of grandparents contribute to their grandchildren’s college savings. And 74% surveyed said they would be willing to help pay college costs.

But this generosity has a dark side. People are living longer, healthcare costs are skyrocketing, and outliving your retirement savings is a real concern for most retirees.

Helping fund your grandchildren’s college educations is a noble cause, but not at the expense of your own financial security.

So if paying for your grandchildren’s higher educations puts your retirement at risk, put your wallet away.

Instead, encourage them to pursue practical, hands-on training for the careers they’re interested in. As many folks like my grandfather learned, college isn’t the only path to a well-paying job.

An “old school” apprenticeship is one ticket to a bright financial future for parents, children and grandparents.

Rather than funding their college experiences, invest that money into your own retirement, and show your grandchildren how they can earn and learn.

Here’s how you can help your grandchildren take advantage of today’s apprenticeship programs to prepare for a solid future – without jeopardizing your retirement.

Apprenticeships Go Back to the Future

Apprenticeships have fallen out of favor since my grandfather graduated from high school in the 1940s. And in recent years, too.

Between 2003 and 2013, the number of U.S. apprenticeships declined 40%.

Misperception is the biggest reason for the decline. Young people view apprenticeships as a path toward blue collar jobs.

Additionally, many mainstream employers have eliminated their formal training programs. They’re reluctant to invest time and money into training workers who might leave for another company after learning the job.

But times are changing – and so is the thinking of employers and students…

The “skills gap” has forced employers to revisit investing in the apprenticeship model.

Too many employers complain that college graduates don’t have the real-world skills needed to successfully perform even an entry-level job. And students are questioning whether or not the cost of a college degree is worth it.

So with bipartisan support from Congress, the Department of Labor has stepped up to help change the face of apprenticeship programs.

The goal of its new ApprenticeshipUSA program is to double the number of apprentices by 2019.

With the help of grants, apprenticeship programs are now available in nearly every industry… from healthcare to IT. The opportunities aren’t limited to blue collar jobs anymore.

High-tech companies like Pfizer, International Game Technology and even Tesla Motors are offering apprenticeships.

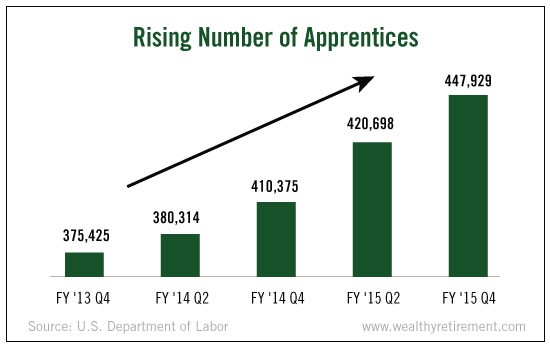

As a result, the number of U.S. apprentices has grown 19% in just two years. And that growth should continue.

The chart below shows the sharp rise in the last couple years alone.

Get Schooled With a Paycheck

Apprenticeship programs benefit both students and employers.

Workers get paid while they learn. And while they may be required to purchase tools or equipment, the cost is minimal when compared to the cost of college. So young folks can get the training they need without taking on debt.

Plus, future employers get to hire employees with the skills they want. Everyone wins.

The typical apprenticeship lasts three years. When it’s done, the average apprentice makes more than $50,000 a year. That’s the same as the average starting salary of a college graduate.

And 87% of apprentices are employed when their program ends.

Today’s new breed of apprentices have a big leg up on college alums. They’ve been making, rather than borrowing, money over the last three years.

So instead of worrying about paying student loans each month, these grads are in the perfect position to begin saving for a home, retirement and more.

And their parents and grandparents are left with more money for their own retirements.

The Un-College Approach

Instead of feeling obligated to fund your grandchildren’s college educations, consider helping them explore the alternatives. An apprenticeship could be the starting point for a viable career.

Remember, a college degree doesn’t guarantee employment – but skills and experience do. An apprenticeship is a practical alternative.

So before the college applications go out, encourage your grandchildren to check out apprenticeship opportunities in the fields of their interests.

The U.S. Department of Labor’s ApprenticeshipUSA database is a great place to start. It provides links to available apprenticeships and participating companies across the country.

Helping your grandchildren prepare for the future is a noble cause. And it doesn’t have to cost you your retirement.

Good investing,

Kristin

[ad#agora]

Source: Wealthy Retirement