Lots of you have been emailing me lately. The question on everyone’s mind is this: What is the best way to protect my investment returns?

As a result, I’ve decided to go over an example on how I would protect profits in the S&P 500 through the rest of 2016.

For most individual investors, buying put options is their answer.

[ad#Google Adsense 336×280-IA]Unfortunately, this strategy is one of the worst ways to protect the stocks in your portfolio.

However, coupling a long put with a simple covered call strategy provides the ultimate protective strategy.

Why?

Because, unlike buying a put for protection and spending money to do so, you can insure a stock against a decline without the need to spend much, if any, capital, using a strategy known as the collar.

Collars are a protective strategy implemented after a stock or ETF has experienced a return that you wish to preserve.

To build a collar, the owner of at least 100 shares of an asset buys one out-of-the-money put option, which grants the right to sell those shares at the put’s strike price. At the same time, the stock holder sells an out-of-the-money call option, which grants the buyer the right to buy those same shares at the call’s strike price.

Collar = (long stock + out-of-the-money short call + out-of-the-money long put [with different strikes])

Because the investor is paying and receiving premium, the collar can often be established for zero out-of-pocket cash, depending on the call and put strike prices. That means the investor is accepting a limit on potential profits in exchange for a floor on the value of their holdings. This is an ideal trade-off for a truly conservative investor.

Confused yet? Let me explain. Because again, using this form of protective strategy will only serve to increase your investment returns going forward and that’s always our goal as individual investors.

Nothing feels better than being invested in stocks when they are going up. The problem arises, however, when the market decides to take one of those classics, a correction not seen in over 2,600 days. When we see hints of a correction, we get a little anxious wondering if this is the big one and start second-guessing ourselves. The real problem occurs when we get one of those calamities that shaves off 30%, 40% or 50%.

So again, the question is this: What is the best way to protect my hard-earned investment returns?

Example: The S&P 500 (NYSE: SPY) has rallied hard over since 2009 and I want to preserve my gains and put a cap on my potential losses, at least over the next few months.

We own 100 shares of the benchmark ETF and would like to protect our profits; the ETF is currently trading for $215

Step 1: So, with SPY currently trading for roughly $215, we need to sell an out-of-the-money call as our first step to protecting our profits.

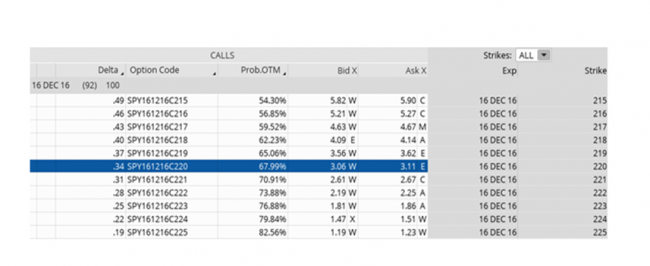

The following is the options chain for December SPY options.

As you can see, the SPY $215 December call options are paying roughly $3.08 per contract or $308 per 100 shares. You could sell call option contracts on your 100 shares, be paid $308, and then use the money to buy the put contracts you need to fully protect your stock.

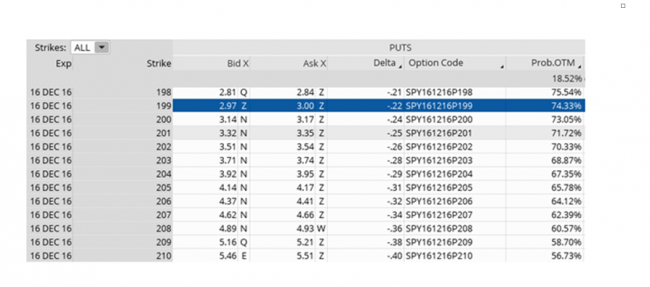

Step 2: If you look at the put options chain for SPY below, you can quickly see that you have the possibility to buy the out-of-the-money put contracts at the 199 strike for $3 per contract or $300 per 100 shares, slightly less than what we brought in from selling the calls. We can use the excess capital to pay for commissions, so the transaction is basically free.

Here’s the catch… your upside is now limited. If SPY increases above $220 per share, at options expiration in December the ETF would be called away from you — in other words, it would be sold for you, at $220 per share. As a result, you lock in the difference of current price of SPY and the $220 strike, or $4.72. The cap on my upside… 2.2%. So, even if SPY advances to say $230, as long as you have these open call options, you are forced to sell at $220 for a 2.2% gain plus the additional gains from holding the ETF over the last several years.

But remember, with this strategy, you’re insured against a disaster, and limited upside is the only shortcoming. Therefore, you use this strategy when you’re on the defensive, concerned about protecting your stocks from potential losses, and don’t see tremendous upside in the near term.

In this example, you are also protected on anything south of $199. So the most you can lose is 7.6%. Compared to the gains the S&P 500 has made since the lows hit in March 2009, a 7.6% loss is certainly tolerable.

Options have become a necessity for the self-directed investor and the aforementioned studies prove the importance of integrating them into your portfolio. Don’t allow yourself to miss out on what IS the future of investing for the self-directed investor.

— Andy Crowder

[ad#wyatt-generic]

Source: Wyatt Investment Research