When it comes to investing, sometimes smaller is bigger. I’m not offering a paradox here. I’m just saying that you can frequently find bigger income in smaller investments.

For example, Chatham Lodging Trust (NYSE: CLDT) is a smallish hotel REIT, with an $820 million equity market cap. Chatham owns 38 hotels located in 15 states and the District of Columbia.

[ad#Google Adsense 336×280-IA]The hotel portfolio is composed of upscale extended-stay and premium-branded select hotels: Residence Inn, Homewood Suites, Hyatt Place, Hilton Garden Inn, Courtyard, and Hampton Inn.

Chatham might be small in stature, but it’s big on income.

Its $1.32 per-share annual dividend yields 6.2% at the going market price.

Better yet, the dividend is parceled out in monthly increments at the rate of $0.11 per share.

The monthly dividend has been raised annually since 2013, when it was $0.07 per share.

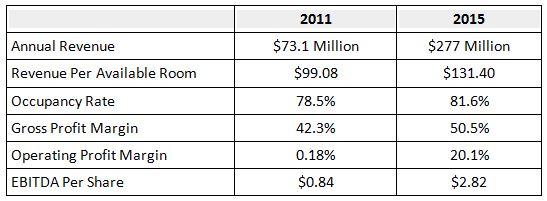

I’m hardly surprised that Chatham has grown its dividend at a 16% average annual rate over the past three years. Everything you want trending in the right direction with a hotel REIT has trended in the right direction for Chatham since 2011.

Most important, funds from operations (FFO) have trended in the right direction. FFO matters because it’s the key metric of dividend coverage. FFO is REIT cash flow. As FFO goes, so goes the dividend.

Most important, funds from operations (FFO) have trended in the right direction. FFO matters because it’s the key metric of dividend coverage. FFO is REIT cash flow. As FFO goes, so goes the dividend.

For this year, Chatham management has guided for FFO per share to range between $2.45 and $2.55. If we take $2.50 as the likely number, that means FFO per share will have increased at a 22% average annual rate since 2011.

This year, Chatham’s FFO per share will exceed dividends per share by more than a dollar. That’s extraordinary. With most REITs, FFO per share will exceed dividends per share by a nickel or less.

Look for more dividend growth in the future. Chatham’s management team has proven value creators. This same team ran Innkeepers Trust from 1994 to 2007. They grew Innkeepers to 75 hotels from seven. During that 13-year run, Innkeepers generated a 318% return for its investors. Innkeepers’ benchmark, the FTSE NAREIT Equity Lodging/Resorts Index, generated a 209% return over the same period. Innkeepers beat its benchmark by 50%.

So, we have the best-run hotel REIT on the market in Chatham Lodging Trust. Why, then, is its share price off 27% over the past year?

It’s not just Chatham; the entire hotel REIT sector has fallen out of favor. The FTSE NAREIT Equity Lodging/Resorts Index is also off 27%.

We have a few macro issues working on Chatham and the hotel-REIT sector.

Tepid economic growth is one issue; more cautious lending is another. Banks have reined in lending to many pass-through entities, mostly energy master limited partnerships. Other pass-through entities have been shunned as well. Call it guilt by association, even if there is no guilt and no association. High yield has been conflated with high risk.

The Federal Reserve has also served as a Damocles sword. Because REITs must tap equity and credit markets to grow, the concern is that the Fed will raise borrowing costs by raising interest rates. I see this as a non-issue. If the Fed has demonstrated one propensity this year, it is a reluctance to raise interest rates.

In short, Chatham is cheap when it shouldn’t be cheap. Its shares trade at only 8.5 times 2016 FFO estimates. This is a ridiculous multiple for proven performance and proven dividend growth, especially given the current low-yield environment.

But let’s say the market fails to embrace my logic. So what? You’re looking at an investment with a history of double-digit annual dividend growth. Each year, more money flows into Chatham’s coffers; each year, more money flows out and into your brokerage account.

If there is one thing I know about dividend growth, you can be sure that the share price will eventually rise with the dividend payout.

— Steve Mauzy

[ad#wyatt-income]

Source: Wyatt Investment Research