Did you know there’s a reliable way to significantly boost the income you’re collecting from the dividend stocks you already own?

I’m talking about ways you can turn 3% yielders into 8% income generators. And it doesn’t involve leverage or any other risky techniques.

I’m talking about “covered calls” – one of the secrets of turning pedestrian blue chip dividends into cash cows.

[ad#Google Adsense 336×280-IA]If you’re not familiar with the practice, read this article on Stock Options Channel about selling calls for income; it covers the basics and is pretty easy to understand.

In short, call options are a kind of insurance on stocks, and you can sell this insurance for cash without putting additional capital at risk, beyond what you’ve already invested in the stock.

Many retirees love covered calls because it gets them immediate income, but many retirees often struggle to find the right stocks for a covered call strategy.

The best way to really boost your income is to find stocks with some volatility and high dividends that have remained relatively range-bound between a low and a high price.

That helps you avoid getting your calls assigned (that is, avoid being forced to sell the shares at the options’ strike price) and allows you to keep doing the same covered call strategy on the same stocks for years.

In other words, we don’t care if our stocks climb in price – in fact, using this strategy, we prefer that they don’t! We love sideways price charts and, as I mentioned, high volatility – which means the options premiums (which we’re selling) are higher. And that means more income for us.

Here are three blue chip stocks that fit the bill. Let me show you how selling calls against these stocks provides yields beyond 8%.

(Call) Option 1: AT&T

AT&T (T) has been a great covered-call stock for years. It stayed mostly between $32 and $38 for four years, making it easy to sell calls and collect premiums without worrying about getting your stock assigned. That changed abruptly in March, when it broke past $38 and has stayed far above—reaching almost $40 in early May.

AT&T (T) has been a great covered-call stock for years. It stayed mostly between $32 and $38 for four years, making it easy to sell calls and collect premiums without worrying about getting your stock assigned. That changed abruptly in March, when it broke past $38 and has stayed far above—reaching almost $40 in early May.

That means this isn’t the best time to do covered calls on the stock, based on history, but changes in the company mean history is less relevant than it use to be. Strong revenue growth from the company’s acquisition of DirectTV has changed market perceptions of the company, and that’s likely to continue.

So if we buy a lot of 100 shares of T and sell a call against them, we can collect a premium of $1.21 per share with a strike price of $39 for an option that expires in January 2017. Combine that with the 5% dividend yield, and our covered T shares are actually yielding 8.1%—not a bad bit of income for a large-cap stock with incredible dividend coverage and a 32-year track record of increasing payouts. But remember we can repeat this trade again in January, which will boost our annual return even higher—possibly to an annualized 11% or more.

(Call) Option 2: Verizon

Sticking with telecom, AT&T’s big competitor is also a handsome dividend growth engine. Verizon (VZ) has more than doubled dividends in the last 30 years, with a 2.7% increase at the start of 2016. It also has everything AT&T has: strong revenue, a reliable business model, high dividend coverage, stellar management and a moat that few other companies can beat.

Sticking with telecom, AT&T’s big competitor is also a handsome dividend growth engine. Verizon (VZ) has more than doubled dividends in the last 30 years, with a 2.7% increase at the start of 2016. It also has everything AT&T has: strong revenue, a reliable business model, high dividend coverage, stellar management and a moat that few other companies can beat.

Verizon also pays 4.6% dividends, which is almost as good as AT&T, but it also lacks the extreme breakout that T enjoyed earlier this year. Instead, it remains in the same range that it’s been stuck in since the middle of 2012: between $45 and $55. Even better—it’s in the middle of that range right now.

So what total yield can we get with our covered calls? Calls expiring in January 2017 for $50 currently trade for $1.83 per share, giving you a total annualized yield of 8.3% including the dividend and the option premium. Add in another sold call in January 2017 expiring in May, and we could be looking at a reliable 12% cash income from Verizon.

(Call) Option 3: Altria Group

Tobacco stocks also boast strong dividend growth track records. Altria Group (MO) pays an impressive 3.5%, and has grown its dividends for the last 46 years—longer than almost any other stock in the world.

Tobacco stocks also boast strong dividend growth track records. Altria Group (MO) pays an impressive 3.5%, and has grown its dividends for the last 46 years—longer than almost any other stock in the world.

When it comes to covered calls, there’s only one problem: Altria keeps going up! That’s partly thanks to a generous stock buyback program and innovations such as e-cigarettes boosting revenues, and that means call sellers need to be more agile when selling their calls.

How do you do that? One way is to set strike prices based on recent price trends. We’re halfway through 2016 and the stock is up almost 10%; if we assume it’ll go up another 10% by the end of the year (an overly aggressive assumption, which is conservative for a call seller), we can set a strike price of $70 for a January expiration.

Here comes the bad news: that means our premium is only 93 cents as of today. That’s only 1.5%, boosting our total payout to 5%. But we’re also very insulated from being exercised (and losing our position). But so what? We’ll have made 10% on our money plus dividends plus the 1.5% premiums we collected – or an 11.5% total return in eight months.

Easier “One-Click” Alternatives

Exhausted? Confused? Many people avoid selling calls because it’s a hassle, it’s complicated and it’s expensive (note that we haven’t considered transaction costs in the above—you’ll pay your brokerage a commission with every call sold, and those commissions tend to be higher than when buying or selling stocks).

This is where closed-end funds come to the rescue. A few “buy-write” funds are out there that automate this process of buying shares and selling calls against the stock—and you have the added bonus of a financial professional managing the taxes, finding optimal strike prices and selecting high quality stocks along the way.

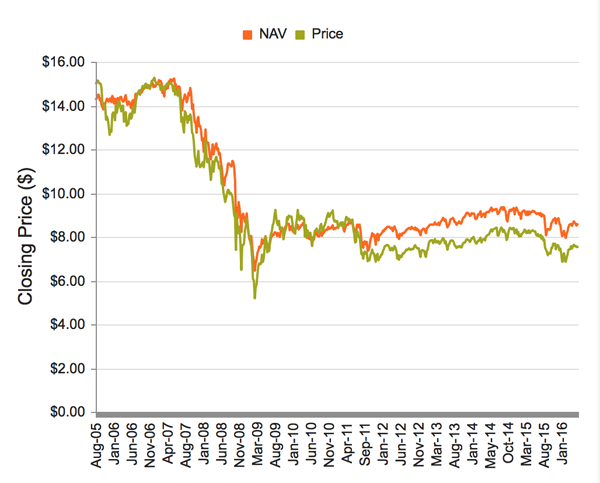

The three biggest by assets under management are the Eaton Vance Tax-Managed Global Fund (EXG), the Eaton Vance Tax-Managed Dividend Equity Income Fund (ETY) and the BlackRock Enhanced Equity Dividend Fund (BDJ). These pay 11.2%, 9.8% and 7.4% yield respectively—which shows how lucrative these fund’s strategies can be.

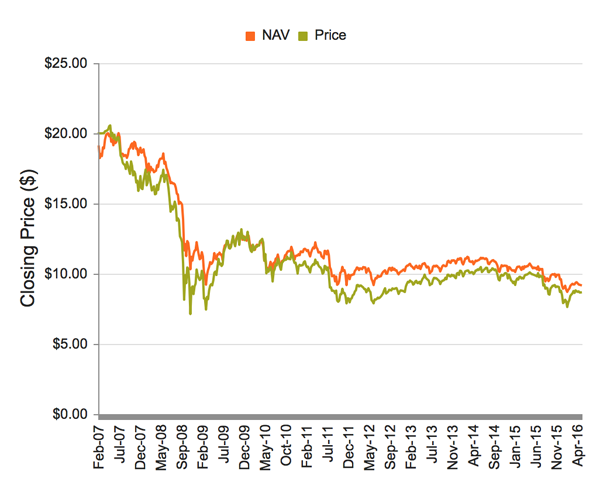

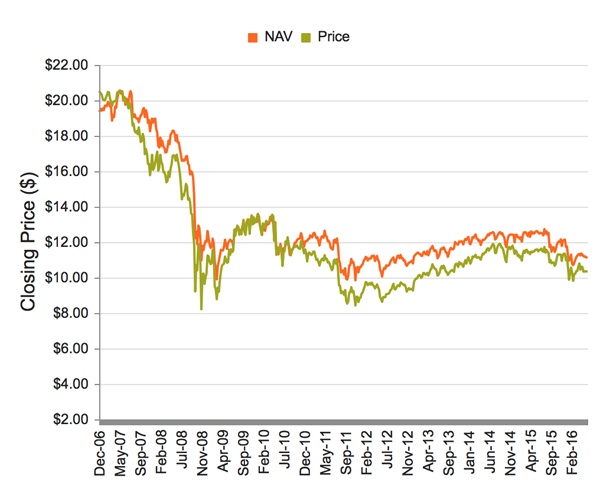

Of course there’s a catch. Each of the funds has cut distributions in the past. EXG and ETY both cut in 2012, while BDJ last cut in 2014. While dividends are being maintained for now, the value of the funds has not recovered from 2008—though many stocks have:

Of course there’s a catch. Each of the funds has cut distributions in the past. EXG and ETY both cut in 2012, while BDJ last cut in 2014. While dividends are being maintained for now, the value of the funds has not recovered from 2008—though many stocks have:

EXG Net Asset Value (NAV) vs Price

ETY NAV vs Price

BDJ NAV vs Price

BDJ NAV vs Price

This doesn’t mean you should avoid a buy-write fund, but it also means that you can’t depend on them alone to get high dividends. To hedge against a market downturn while still getting income, you need to build a portfolio of funds that have high payouts while investing in different assets.

This doesn’t mean you should avoid a buy-write fund, but it also means that you can’t depend on them alone to get high dividends. To hedge against a market downturn while still getting income, you need to build a portfolio of funds that have high payouts while investing in different assets.

Many retail investors don’t know where these funds are or how to buy them, but billionaire “Bond God” Jeffrey Gundlach has been aggressively pounding the table on these “slam dunk” income plays.

If you want to learn more about his strategy, and three favorite picks including fund names and tickers, click here to read exactly what he recommended.

— Brett Owens

[ad#wyatt-income]

Source: Contrarian Outlook