It’s time for a pause in the gold-stock rally.

The Market Vectors Gold Miners Fund (GDX) is up 77% since bottoming in January. It has been a straight move higher – practically vertical.

And by the end of the year, gold stocks are likely to be even higher than where they are today.

But in the short term, we may have a problem.

You see, one of my favorite gold-stock timing indicators just triggered a sell signal…

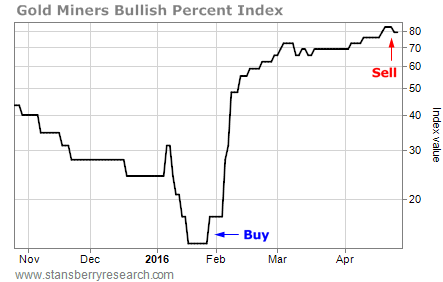

Take a look at this chart of the Gold Miners Bullish Percent Index (or “BPGDM”)…

A bullish percent index is a gauge of overbought and oversold conditions. It measures the percentage of stocks in a sector that are trading in a bullish technical formation. Since it’s measured as a percentage, a bullish percent index can only reach as high as 100 or fall as low as zero.

[ad#Google Adsense 336×280-IA]Typically, a sector is extremely overbought when its bullish percent index rallies above 80.

It’s extremely oversold when it drops below 20.

Trading signals are triggered when the index reaches extreme levels and then reverses.

For example, back in late January, the BPGDM turned higher from a deeply oversold reading of 13.

That action triggered a buy signal.

GDX was trading for less than $13 per share back then. On Tuesday, GDX closed around $23 per share.

That proved to be one heck of a buy signal.

But now, we have a problem.

Last week, the BPGDM rallied above 80 – signaling an extremely overbought condition in the gold sector. On Monday, the index turned lower.

That’s a sell signal… and it’s a short-term warning sign for the gold sector.

Of course, this doesn’t mean that you should go and sell all of your gold stocks. There are plenty of valid, longer-term reasons to own gold stocks. And as I mentioned earlier, I expect the sector to trade even higher than today’s levels later this year.

But if you’ve participated in this amazing rally in the gold sector over the past three months, consider locking in some profits right here. At the very least, tighten your stops on your gold stocks to prevent giving back too much of those gains.

And if you’re looking to buy into the gold sector, this new BPGDM sell signal suggests you may have a better chance to do so in a few weeks.

Best regards and good trading,

Jeff Clark

[ad#stansberry-ps]

Source: Growth Stock Wire