Gold is unlike any other asset…

It has industrial uses. Sure.

But throughout history, people around the world have used gold as savings.

[ad#Google Adsense 336×280-IA]People lock up and hide their gold jewelry, coins, and bars… just as they would a big stack of cash. They think about their gold as a portion of their wealth.

In other words, it’s similar to a currency like the U.S. dollar, euro, or yen.

Only it’s not used in everyday trade… and it can’t be printed by governments.

That’s why it’s a favored form of savings among folks who are concerned about inflation in their dollars, euros, and yen.

Yet most people don’t measure gold in the same way they measure other currencies. Consider how we measure the value of the U.S. dollar…

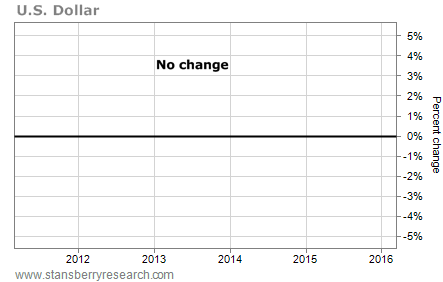

If you measure the value of the dollar in your native currency (which is the U.S. dollar, if you live in the U.S.), what do you see?

One dollar is always worth one dollar. It never rises or falls. Without factoring in inflation, it will buy you the same number of pencils and penny candies.

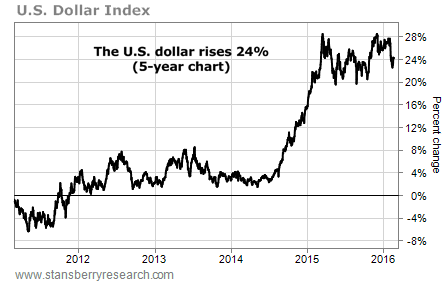

That’s not useful… So we measure the dollar against a basket of major foreign currencies. This shows us how the dollar is valued on the international stage.

The widely used U.S. Dollar Index measures the dollar’s value against that of the euro, Japanese yen, British pound, Canadian dollar, and Swedish krona (in order of weighting). Here’s a five-year chart of the U.S. Dollar Index…

By this measure, the U.S. dollar is worth 24% more today than it was five years ago. Folks who hold dollars can buy 24% more foreign goods, services, and real estate.

By this measure, the U.S. dollar is worth 24% more today than it was five years ago. Folks who hold dollars can buy 24% more foreign goods, services, and real estate.

Like the dollar or any other major currency, gold is an international asset. You can measure it in your native currency… and you should. But that’s a limited view of its value…

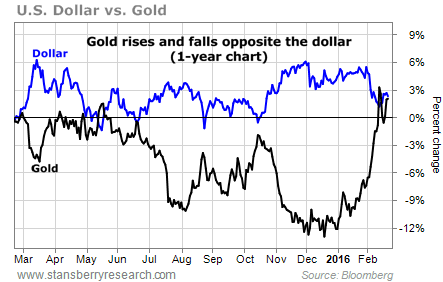

When you only measure gold in U.S. dollars, the dollar’s change shows up in the price of gold. When the dollar gets stronger internationally, it buys more gold… So it looks like the value of gold goes down. When the dollar gets weaker internationally, it buys less gold… So it looks like the value of gold goes up.

This relationship is clear in the one-year chart below. It shows the percent change in the U.S. Dollar Index (the blue line) and in the price of gold in U.S. dollars (the black line).

Because of this relationship, looking at gold’s price only in U.S. dollars can mask what’s happening with the metal on the international stage…

For example, over the last two years, the U.S. dollar has risen sharply… So lots of folks don’t realize that gold has been in an uptrend (internationally) that whole time.

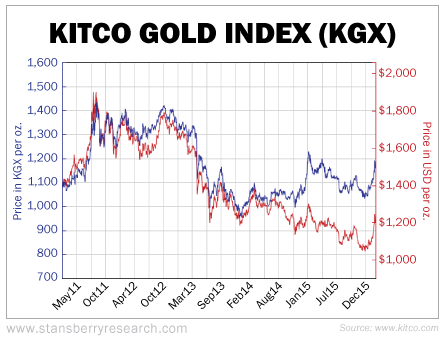

We can see this by looking at the Kitco Gold Index. Kitco is a great free source for precious metals information. It makes a point to show how much of an asset’s price change is due to changes in the dollar… and how much is due to fundamental factors like supply and demand.

The Kitco Gold Index measures the price of gold against the same basket of foreign currencies that the dollar is measured against in the U.S. Dollar Index. In the five-year chart below (pulled from Kitco’s website), you can see the Kitco Gold Index (the blue line) and the price of gold in U.S. dollars (the red line).

You’ll notice that gold measured in international currencies bottomed in February 2014. It has been slowly moving higher for the last two years. Gold in U.S. dollars, on the other hand, has been in a steady downtrend.

Lots of people in the U.S. are predicting a new uptrend in gold, starting now. But gold is already in an uptrend around the world. It has been for two years.

That’s why, if you want to understand what’s happening in the gold market, you have to know what’s happening with gold relative to the U.S. dollar… and you have to know what’s happening with gold relative to other currencies.

It’s one of the most important ideas most investors don’t understand.

Regards,

Ben Morris

[ad#stansberry-ps]

Source: Growth Stock Wire