If you’re anything like most Americans, you drink coffee every day.

Around 100 million U.S. adults do. On average, they spend nearly $165 per year on it. That’s why we import about $4 billion worth of coffee annually. In total, the U.S. coffee market is worth about $18 billion.

And right now, your morning cup of joe could make for a good investment…

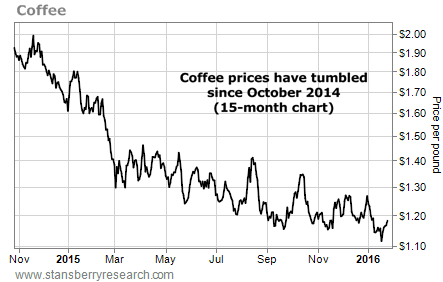

As you can see in the following chart, the price of coffee – the raw, unroasted beans – is down nearly 50% from its highs in October 2014…

Today, it is at its lowest level since November 2013.

Today, it is at its lowest level since November 2013.

SentimenTrader.com – an excellent website that tracks investor sentiment – suggests that coffee prices aren’t heading higher any time soon.

[ad#Google Adsense 336×280-IA]However, if they fall further, speculators looking to bet on rising coffee prices could buy the iPath Pure Beta Coffee Fund (CAFE) or the iPath Bloomberg Coffee Fund (JO).

Both funds track the price of coffee using futures contracts.

Either would be a good way to profit when coffee prices eventually start to rise.

But today, the better opportunity is in the companies that sell the coffee.

We’ve already seen some big gains in the sector. In December, private-equity firm JAB Holding purchased specialty coffee maker Keurig Green Mountain for $14 billion. Investors made 72% overnight.

And with the price of beans falling 30% over the last year, it’s no surprise that coffee giant Starbucks (SBUX) saw its highest profits in years in late 2015. That’s not entirely due to cheaper beans, but they certainly helped.

Coffee wholesaler Farmer Brothers (FARM) has several proprietary coffee brands in grocery stores. It also supplies coffee to many “gourmet” coffee shops. Like Starbucks, Farmer Brothers’ last four quarters were excellent. Cost of revenue fell and gross profits rose in each of the last four quarters.

The same trend can be seen in the $100 million small-cap coffee company Ten Peaks Coffee (TPK.TO). The Canadian firm also saw much higher profits in 2015.

Investors looking to find a creative way to pay for their java habits should look at the companies that sell coffee. With prices low and showing no signs of rallying any time soon, these companies should continue to post excellent profits for the next couple of quarters.

Good investing,

Matt Badiali

[ad#stansberry-ps]

Source: Growth Stock Wire