New technology companies are a driving force in the current economy. With overall growth flat or declining in many sectors, a dose of new tech company exposure could add a nice return boost to your portfolio.

However, not all new tech IPOs are successful, and many recent public offerings now have share prices that are much lower than where traded on the IPO date.

[ad#Google Adsense 336×280-IA]One business development company can give you exposure to the next generation of tech winners and let you earn a nice dividend yield as you wait.

New tech startups go through several phases before they go public or are bought out by a larger company.

In the early days of a new company’s life, venture capitalists provide the money the new enterprise needs to develop and grow its business.

The VC’s take equity or ownership stakes in the new companies.

At this stage the success of a new company is not certain.

Venture capitalists take high-risk gambles on new startups with the expectation that a few will survive, become very successful and generate very large returns on the initial equity investments.

As the new tech company moves through its early life cycle, the business will reach a level where the business is viable, but not yet large enough to put the company on the market, either as an IPO or to a private buyer. At that point, the VC company does not want to make additional equity investments and dilute its position in the company.

This is where today’s focus company comes in. Hercules Technology Growth Capital Inc. (NYSE: HTGC) is a business development company (BDC) that provides business loans to expansion stage technology companies.

This is where today’s focus company comes in. Hercules Technology Growth Capital Inc. (NYSE: HTGC) is a business development company (BDC) that provides business loans to expansion stage technology companies.

Hercules maintains relationships with over 500 venture capital and private equity firms, and these firms direct their investments to talk to HTGC about their business borrowing needs.

Hercules Technology Growth Capital spreads its loans out across a lot of companies. Currently, its $1.2 billion loan portfolio includes debts to 87 different companies.

Over its 12 year business life HTGC has made loans to over 325 different companies. Loans have floating interest rates currently averaging 9.4% with terms of 36 to 42 months.

As a BDC, Hercules can use up to 50% leverage with debt financing, which produces an effective yield of 12.6% on the loan portfolio. The final kicker is that HTGC also receives warrant and/or equity positions from its client companies. The equity pieces provide extra profits to Hercules when a portfolio company launches an IPO or is taken over in an acquisition.

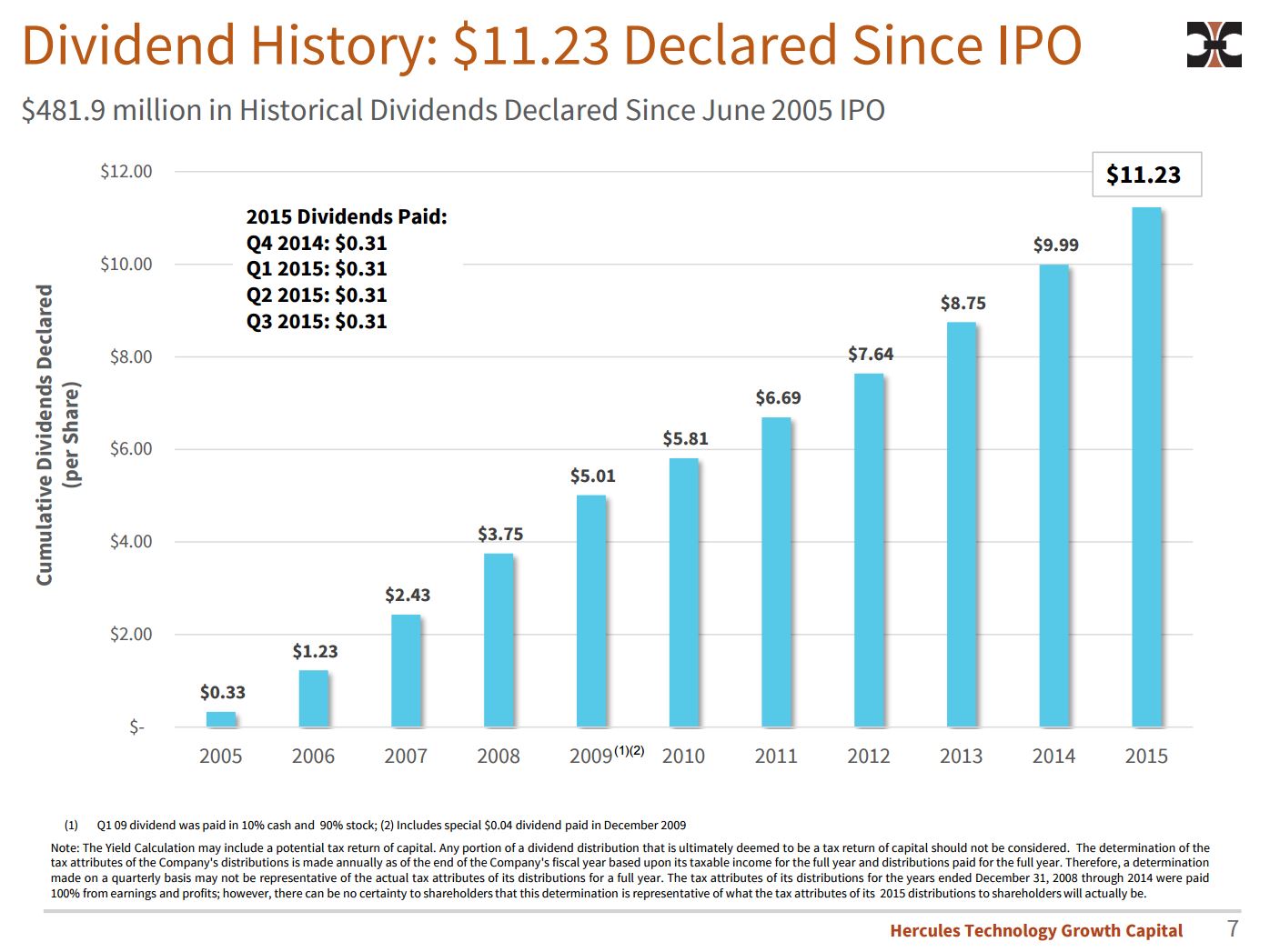

Basically, Hercules gets a small, but meaningful, no-cost piece of the venture capital action in each tech company it provides financing to. Historically, the equity component has added an additional 3% to 4% to HTGC’s annual returns on its invested capital. The equity investment returns can be bumpy, which is one factor that leads to the HTGC share price volatility. However, the company has a very strong history of steady dividend payments with occasional increases.

To quote from a BDC focused analyst:

To quote from a BDC focused analyst:

“It is one of the ironies of investing in the BDC sector that day-to-day stock market price activity tends to the volatile while distributions are very consistent, especially taken in aggregate. (For example, Hercules Technology or HTGC was up 10% last week in a few minutes on a slightly better than expected earnings report, yet its dividend has been unchanged for 2 years.)”

Good News for 2016

Hercules has made a couple of positive announcements over the last couple of weeks. First, the company clarified that all of its customer loans are variable rate, which means that interest income will increase as rates move up. At the same time, all of Hercules’ own debt is fixed rate, so interest expense will not be increasing as rates move higher. According to the company, a one percent increase in interest rates results in a $9 million or $0.13 per share in net income.

The company has also announced it will retire $40 million of 7.00% Senior Unsecured Notes due September 2019. This will provide an additional $3 million per year of interest expense savings.

While it is tough to predict when Hercules Technology Growth Capital will be able to raise its dividend rate, the current quarterly payout of $0.31 per share is secure. That provides a current yield of 10.5% – not too shabby. HTGC is a holding that will provide long-term benefits from its investments in start-up technology companies and the short term benefit of a high current yield.

— Tim Plaehn

Sponsored Link: Finding companies that regularly increase their dividends is the strategy that I use myself to produce superior results, no matter if the market moves up or down in the shorter term. The combination of a high yield and consistent dividend growth in stocks is what has given me the most consistent gains out of any strategy that I have tried.

And, there are currently over twenty of these stocks to choose from in my Monthly Paycheck Dividend Calendar, an income system used by thousands of dividend investors enjoying a steady stream of cash.

The Monthly Dividend Paycheck Calendar is set up to make sure you receive a minimum of 5 paychecks per month and in some months 8, 9, even 12 paychecks per month from stable, reliable stocks with high yields. If you join my calendar by Tuesday, December 29th you will have the opportunity to claim an extra $2,688.50 in dividend payouts by January.

The Calendar tells you when you need to own the stock when to expect your next payout, and how much you can make from stable, low-risk stocks paying upwards of 12%, 13%, even 15% in the case of one of them. I’ve done all the research and hard work; you just have to pick the stocks and how much you want to get paid.

The next critical date is Tuesday, December 29th (it’s closer than you think!), so you’ll want to take action before that date to make sure you don’t miss out. This time, we’re gearing up for an extra $2,688.50 in payouts by January, but only if you’re on the list before the 29th. Click here to find out more about this unique, easy way of collecting monthly dividends.

Source: Investors Alley