There’s nothing like a market swoon when it comes to unleashing the most damaging of all investor behaviors – emotional decision making.

We’ve talked a lot about how catastrophic this can be during our time together with good reason – investors who make knee-jerk decisions damn themselves to abysmal returns.

[ad#Google Adsense 336×280-IA]Today, we’re going to revisit the subject because emotions are running high right now and millions of investors are at risk of doing something stupid. I don’t want you to be one of them.

What I am about to share with you may make you uncomfortable.

I totally get that. In fact, I’m hesitant to bring it up because it could easily be taken out of context.

But I am going to do so anyway for one simple reason – if you understand why Wall Street doesn’t talk about what we’ve going to cover today, then you’ll be perfectly positioned to understand the implications associated with what I want you to do next – and the tactics you’ll need to succeed.

Here’s what you need to know about the tactic that may already be costing you 190% returns.

Brain-Damaged Investors Make Better Decisions

Nearly 10 years ago, I came across a study in Psychological Science that was as profound as it was politically incorrect, at least on the surface, anyway.

The implications are pretty striking so you’d think Wall Street would have been all over it but, sadly, they’re not and won’t ever be. In fact, the only time I’ve ever seen it mentioned in the years since was by another fiercely independent financial analyst like myself, Ric Edelman, CEO of Edelman Financial.

Here’s what it says.

Researchers at three major universities – Stanford, Carnegie Mellon and the University of Iowa – published findings showing that brain-damaged individuals made better investment decisions than the rest of us.

To be precise, what they studied was the impact of injuries that prevented the brains of the injured from processing emotional stimuli and, by implication, responses to those specific inputs.

Researchers found that when they compared the findings to folks with no brain damage, the “injured” individuals made significantly better investment decisions.

That’s because the human brain is wired to evaluate economic and investing information using connections and pathways that are closely linked to emotional inputs. You’d think this kind of decision-making would involve logical brain pathways, but that’s not true.

This is why making decisions with your money can be very challenging, especially when the markets are uncertain and the investing landscape emotionally charged like it is right now. Because you are taking what should be a logical decision and using emotional receptors to make it.

It’s also why Wall Street wants you to believe money is complicated and why their ads are so slick. Unlike the average individual investor, the Big Boys have spent billions understanding what makes your mind work and how specific inputs prompt specific actions on your part – chief among which is commission-generating buying and selling activity that’s worth $18 billion or more a year to the top 25 firms.

They know that if you’re happy, then you’re generally going to be a buyer, and that if you’re sad or fearful, you’ll be a seller. And usually at precisely the wrong time, I might add.

The result is tremendous underperformance that gets dramatically worse over time.

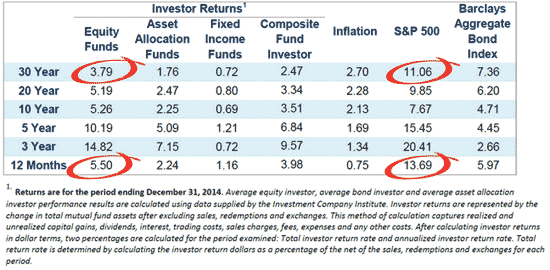

Case in point, the latest DALBAR data shows that equity fund investors averaged only 5.50% in 2014 versus the S&P 500 which turned in 13.69% over the same time frame – an 8.19% difference.

That may not sound like much, so let me put that in perspective.

Taken over 10 years, that difference means $10,000 socked away by the average investor would turn into $17,081.44, or a gain of 70.08%. But a $10,000 investment that matched the S&P 500’s return would amount to $36,076.35 in the same 10 years – a return of just over 260%. The difference is 190%, or nearly triple your money.

I don’t know anybody – rich or poor – who can afford to throw that kind of potential away.

I don’t know anybody – rich or poor – who can afford to throw that kind of potential away.

Again, this is an uncomfortable subject for a lot of investors.

Many of my own subscribers, in fact, thought I’d lost my marbles when I told them in 2007 to batten down the hatches at a time when they wanted to chase performance. On the way down, those who followed along with my recommendations had the opportunity to enjoy returns like the 101.68% we captured in iShares MSCI Brazil Capped (NYSEArca:EWZ) and 83.33% from iShares China Large-Cap (NYSEArca:FXI) respectively.

The same thing happened in March 2009 when I told them that it was time to buy. On the way up, those same subscribers had the opportunity to capture a slew of double- and triple-digit winners like CNH Industrial NV (NYSE:CNHI), Navios Maritime Holdings Inc. (NYSE:NM), and ABB Ltd. (NYSE:ABB) which we closed out at 104.43%, 104.05%, and 103.12% in three trades, respectively.

So how do you do the same thing, especially now when the markets are acting up again?

Three Ways to Remove Emotion from the Equation

Success comes down to removing emotion from the equation… actually, in much the same way injuries removed the emotional processing from individuals in the research I just told you about.

First, use a “risk-parity” portfolio model like the 50-40-10. Wall Street will try to convince you that diversification is the way to go, because not all assets go down at once if things blow up. But there’s a flaw in that model. Spreading your money out to get the lowest mean gains is not a recipe for wealth – in fact, it leaves you at the mercy of unseen risks. Ask anybody who got “halved” twice in the last decade how diversification worked out! Long story short, it didn’t. The best professional investors of our time DO NOT blindly distribute their money across a slew of asset classes, and you should not do it either.

The better way to go is a “risk-parity” model, like the 50-40-10 portfolio I advocate in the Money Map Report. (I’ll show you exactly how this in an upcoming column.) By concentrating assets and periodically rebalancing between core assets, growth/income, and speculative positions, you are effectively “forcing” yourself to buy low and sell high using proven logic – not emotion. Plus, this keeps performance-robbing fees low, which Wall Street hates but you’ll love because it can add a lot to your returns over time.

Second, capitalize on chaos. If you’re like me, you grew up with “buy low, sell high” being pounded into your head. It’s absolutely true – but emotion makes it hard to apply. Knowing that everybody else is panicking should be an open invitation to put new capital to work when prices are low. The key is buying companies that have solid business models and long-term growth potential at a time when they’ve been temporarily put on sale by short-term events.

Third, use simple trailing stops to protect your capital and control risk. The goal here is, again, to remove emotion from the equation. Having a trailing stop percent that’s pre-selected the moment you buy helps you do just that. I typically recommend setting a 25% trailing stop on most investments. As an added benefit, trailing stops help you maintain a calm, reasoned perspective at times when everybody else is seemingly losing their minds (and making tremendously costly decisions that are not in their best interest).

Most online platforms have stops built in. So there’s no excuse for not using them.

To be fair, the common complaint I get on trailing stops is that they force you to sell when you may not want to. I hear ya, which is why I’d like to point out that you can use options or inverse funds to accomplish the same thing.

For now, just remember, the more “sophisticated” you get, the higher the risk of emotional decision-making. And that’s not the goal.

Simplicity, security, and the tactics needed to harvest big profits – that’s the goal.

Best regards for great investing,

Keith

[ad#mmpress]

Source: Total Wealth Research