Do yourself a favor and forget this next fact entirely…

The stock market has risen 206% over the past six years.

We recently hit the sixth anniversary of this stellar bull market.

It was March 9, 2009 when the market bottomed after the financial crisis.

[ad#Google Adsense 336×280-IA]If you had the guts to buy stocks at that time, you’ve done great.

However, the bull market is getting old. Six years is a long time.

That makes a lot of individual investors and some market prognosticators nervous.

But it shouldn’t. Here’s why…

The stock market has no memory.

It doesn’t know where it has been. It doesn’t care how much it has risen or fallen.

Over any realistic time frame, it responds to economic strength, business fundamentals, and valuation.

Forget about the bull market. It doesn’t tell you what’s going to happen next.

Instead, we need to look at what’s happening in the market today and discern what that means for our investments. Here’s what we’re seeing right now…

Flights are full… A few weeks ago, my flight was loaded and I accepted $600 from the airline to take a later flight. It’s one of my favorite money-saving “hacks,” and it’s happening more frequently because the airlines are overbooking again.

Rental cars are sold out, too. I was recently asked if I’d take a minivan instead of my reserved compact car – a swap I was less happy to accept.

No question, the economy is doing well. But it’s not doing great…

Yes, unemployment has improved from a peak of 9.9% in April 2010 down to 5.5% today. But that’s not really “low” unemployment. That’s about average.

The economy also doesn’t show any signs of inflation. If anything, deflation is a greater fear. And any student of economic history knows you can’t have a runaway boom without rising prices. It’s simply contrary to the “laws” of economics.

So while the economy has improved a great deal from its crisis six years ago, it still has a good deal of room to improve.

Meanwhile, stocks aren’t expensive…

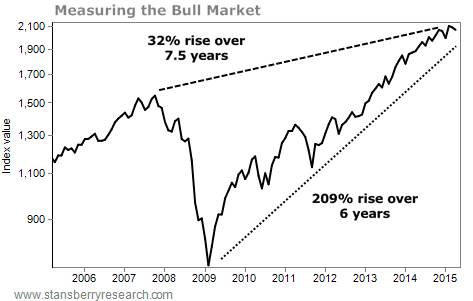

Yes, the bull market has pushed the market up 206%. But the vast majority of that rise was just for stocks to get back to the prices they should have been at without the disruption of the 2008-2009 financial crisis. Stocks are up just 32% from pre-crisis highs. Take a look:

Today, the S&P 500 is priced at about 18.5 times earnings. But consider this… during times of low interest rates and inflation (like we have now), stocks deserve a higher valuation.

With high interest rates, the expectation is that you’ll have more money in the future than you would with low rates, so the price you’ll pay for earnings today (the P/E ratio) drops when inflation and high interest rates are around.

But when interest rates and inflation are low… a dollar in the future is worth more than it would be if inflation has been eating away at it. That forces investors into risky assets like stocks. And that leads to higher valuations.

Even more interesting to me… since the crisis, corporate earnings per share have grown 934% – more than the market has risen. But that’s starting from a time when companies were taking drastic one-time write-offs. So the gains are not as wild as they first look. From the 2007 peak to now, earnings per share are up just 12%.

Meanwhile, corporate debt has declined dramatically. In 2007, using S&P 500 stocks as our barometer, corporations had roughly $0.39 borrowed for every $1 of assets. Today, that has dropped to $0.23. So these companies are much less leveraged, making their stocks safer in turn.

All of a sudden, some stocks don’t seem expensive. They seem cheap.

Few people realize it. Most investors are scared right now. But we’re excited for what could become the longest bull market on record.

Here’s to our health, wealth, and a great retirement,

Dr. David Eifrig

[ad#stansberry-ps]

Source: Daily Wealth