One of the recent trends I have seen in the market is some of the industrial and construction plays that have plunged with the price of crude oil are posting much better than expected results.

These stocks are now staging impressive rallies that are only just beginning.

[ad#Google Adsense 336×280-IA]Given how severely and unfairly these shares were beaten up this is not surprising.

Patient value investors are being rewarded for scooping up these cheap shares while panic engulfed everything connected to the oil and gas industry over the past few months.

These stocks might be early in a significant move as they still sell way below their levels before the energy complex started its descent during last summer.

There is still time to catch their rallies as the stocks start to move closer to their fair valuations. Here are three of these contrarian stocks I own and still see further upside for over the next few months.

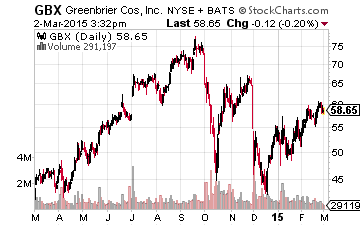

Let’s start with railcar maker Greenbrier Companies (NYSE: GBX).

Let’s start with railcar maker Greenbrier Companies (NYSE: GBX).

Back in early January I highlighted this manufacturer as being unfairly sold off on the decline in crude and told readers on Investors Alley to pick up these cheap shares before oil started to bottom and sentiment became more positive on these beaten down shares.

The stock is up more than 20% since then and slightly more than that since being included in The Turnaround Stock Report portfolio in December. However, the stock is still down some 25% from its highs late last summer.

The company easily beat top and bottom line expectations when it delivered its last quarterly results. In addition, Greenbrier’s order backlog continues to grow and is at record levels with 70% of new orders coming from outside the energy sector. The company provided earnings per share guidance during its last quarterly conference call of $5.20 to $5.50 a share in FY2015.

This would be better than a 70% year-over-year increase over FY2014. Analysts believe another 10% to 15% gain is also in store for FY2016 which begins September. Even with the stock’s recent rally, the shares go for 11 times this year’s expected earnings, a significant discount to the overall market multiple despite Greenbrier’s superior growth prospects.

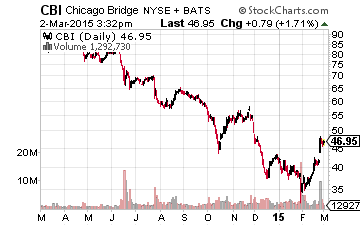

Next up is another Turnaround Stock Report winner in the form of engineering & construction giant Chicago Bridge & Iron (NYSE: CBI).

Next up is another Turnaround Stock Report winner in the form of engineering & construction giant Chicago Bridge & Iron (NYSE: CBI).

The shares are also up more than 10% since I included the name within my “Best Ideas” list at Real Money Pro in mid-February prior to quarterly results.

My faith was rewarded as the company easily exceeded expectations last Wednesday and the stock soared, as a result.

Even with the stock’s recent strength it is going for just over half of its 52 weekly high. During its conference call, the management of Chicago Bridge & Iron lifted both its earnings and revenue projections for FY2015 above the existing consensus. The company now expects earnings per share of $5.55-$6.05 this fiscal year on revenues of $14.4 billion to $15.2 billion.

This would represent a 10% to 15% gain in profits year-over-year from FY2014. Chicago Bridge & Iron has an order backlog north of $30 billion, over two years’ worth of work at current run rates.

In addition, almost all of the demand from the oil and gas sector is from the midstream and downstream areas that are not suffering the severe capital expenditure cuts the exploration and production space is currently experiencing. The stock is cheap at eight times the mid-range of expected earnings per share from the company’s recent earnings guidance for this fiscal year.

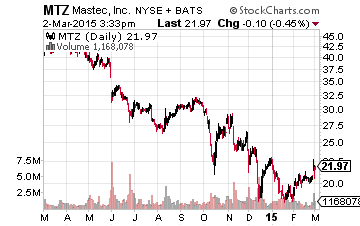

Finally, we have Mastec (NYSE: MTZ) whose main customers include wireless carriers, the electrical transmission sector, and the oil and gas complex.

Finally, we have Mastec (NYSE: MTZ) whose main customers include wireless carriers, the electrical transmission sector, and the oil and gas complex.

The company reported solid results on Friday and the stock was up significantly on the day because Mastec beat both top and bottom line expectations.

The stock is now up some 15% since being included in the Small Cap Gems portfolio in late January (shameless plug).

Even with the recent rally, the stock sells for roughly half of its 52 weekly highs. Also like Chicago Bridge & Iron, most of the approximately 40% of Mastec’s overall revenues that come from the energy sector come from pipelines and refineries, not the production companies that are under such duress due to the huge sell-off in crude over the previous nine months.

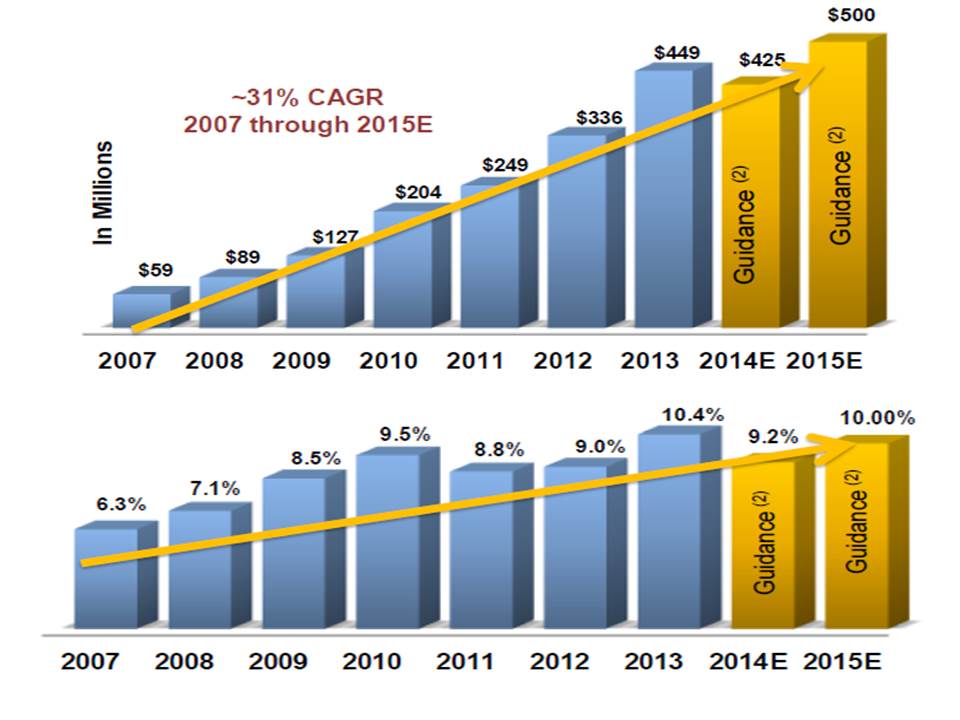

The company has done a stellar job diversifying away from its core electrical transmission business over the past six to eight years. This has powered an impressive record of earnings and margin growth over that time period. This is merely a hiccup in that journey.

Mastec should see earnings increase 10% to 15% annually for both FY2015 and FY2016 and the stock sells for just 12 times forward earnings.

Mastec should see earnings increase 10% to 15% annually for both FY2015 and FY2016 and the stock sells for just 12 times forward earnings.

It seems that all of these stocks were oversold and are still selling significantly under their fair value. I expect the recent rallies in their shares to continue.

— Bret Jensen

[ad#ia-bret]

Source: Investors Alley