In the past two months, U.S. consumers have saved $8.4 billion.

In the past two months, U.S. consumers have saved $8.4 billion.

It’s all thanks to the 29% decline in crude oil since June. Cheaper oil means cheaper gasoline… and over $8 billion in gas savings for the consumer.

Remember, the $8.4 billion in savings is only counting prices at the pump.

Every tick lower in oil prices pumps billions into the pockets of consumers, small businesses, and large corporations.

[ad#Google Adsense 336×280-IA]The CEO of construction equipment maker Caterpillar (CAT) has stated that if oil stays below $95, it will be “the kind of stimulus package that the Federal Reserve or Congress could never do.”

Nothing is more powerful to the global economy than the price of oil.

And the massive move down has created equally extreme opportunities for investment.

Today, I’ll show you how my readers are also using lower oil prices to collect more safe income.

Coupled with lower gasoline expenses, I like to think of this opportunity as a sort of free-market “stimulus package.”

But first let’s take a look at where oil is headed from here…

Oil, like all commodities, follows a distinct and obvious cycle. Here’s how it works…

When prices are low, there’s little reason to explore new areas or invest in new technologies. Producers will run through the current wells and produce what is profitable. At a certain point, though, the current wells start to wind down and prices begin to climb… leading producers to start investing in new discoveries or new technologies.

When prices really get high, a full-on boom mentality takes over. Producers exploit every resource they can get their hands on.

Developing commodities takes time. These projects take months and years to really get cooking, and before you know it, there’s too much of the commodity around. Prices fall again and the cycle starts over.

Oil has seen the same thing many times over.

It was the extreme rise in oil prices to $140 that sped along the development of the U.S. oil-and-gas boom. If prices had stayed at $60, where they were in 2007, it’s less likely that companies would have considered researching horizontal drilling and hydraulic fracking technologies.

High prices seven years ago created today’s boom in oil production. Now, we’re seeing the effects of a glut.

Today’s falling oil prices stem partially from slowing demand. The U.S. economy is growing, but there’s trouble elsewhere. Europe and Japan are struggling with near-deflationary environments. According to the IMF, the euro area is expected to post growth of just 1.8% in 2015. Japan is expected to grow 0.8%.

Meanwhile one of the biggest energy consumers – China – is in danger of seeing annual growth drop to less than 7%. South America is struggling with debt and inflation problems.

But slowing demand isn’t the only culprit in oil’s decline – overall, the world economy is still expected to grow 3.8% in 2015. We also have to consider supply.

In my Retirement Millionaire newsletter, we pointed out on July 9 that oil prices were likely to fall from $106 a barrel.

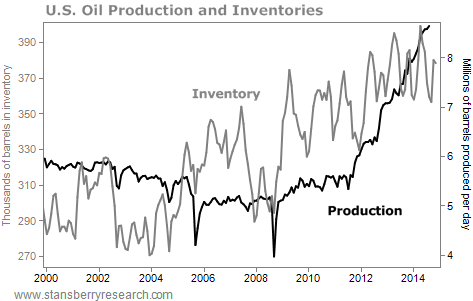

We didn’t use a sophisticated model or insider contacts to figure that out. You could see it in production and inventories.

U.S. production has grown to 9 million barrels per day. That’s up from 4.5 million in 2008. And it’s just behind the 9.6 million barrels of the world leader, Saudi Arabia. You can see inventories rise as production increases.

Oil inventories are stores of oil sitting in tanks and other holding places, waiting to head to a refiner or other end market. There’s only so much storage capacity, and it costs money to use it. When inventories get high enough, prices have to drop to clear out all the excess.

Oil inventories are stores of oil sitting in tanks and other holding places, waiting to head to a refiner or other end market. There’s only so much storage capacity, and it costs money to use it. When inventories get high enough, prices have to drop to clear out all the excess.

In addition to inventory buildup in the U.S., we’ve seen growth in global inventories as well. Despite the turmoil in Russia and the Middle East, production from those areas has held up. Saudi Arabia has also been aggressively producing oil and cutting its price to U.S. buyers.

This extra supply in the short term has contributed to oil’s collapse. But the drop won’t last forever…

With the fall in oil prices, it won’t take long for the excess supply to clear out.

In the short term, we think oil’s move has run its course.

There’s another feature to the commodity cycle that helps us figure out where oil prices are going. It’s the fact that, over the long term, oil’s price can’t stay too far below the costs of production. If it does, producers stop producing, and prices rise.

In the Middle East, the cost of finding and lifting oil out of the ground runs just $16 per barrel. An offshore rig in the U.S. costs about $51 per barrel. Hydraulic fracking in the U.S. costs between $50 and $100 a barrel, and the International Energy Agency (IEA) says that about 96% of U.S. production could still run as long as oil stays above $80. Canadian oil sands can take $90 a barrel to produce.

We expect oil prices to balance out around $80 in the mid-to-long term. That price allows for deepwater and U.S. shale production to continue. If oil falls below $80, those production methods start to become questionable, and the supply of oil will drop sharply.

Since prices don’t just sit at a level that “makes sense,” we need to give the price some wiggle room. The natural price of oil should be between $60 and $90 a barrel for the next few years.

Oil fell to about $75 today, so we’re more on the cheap side of that range.

Every investor knows that buying cheap is better than buying expensive. Contrarian investors are wisely using this as an opportunity to pick up quality oil investments.

For example, my colleague Porter Stansberry sees oil going to $60 a barrel within the year. Even so, he recommends buying oil and gas stocks.

He recently wrote: “Investors will panic as crude oil prices fall. But I would buy on those dips… because we are still in the early stages of the most important economic trend of our lives.”

The rising production from skilled producers will more than offset the effect of lower prices.

That’s why today, I’m recommending my readers buy shares of big, diverse oil companies. These “major integrated oil companies,” as they call them in the business, don’t have just a few oil wells. And they don’t just produce oil and natural gas. They also refine, transport, and sell gasoline to drivers.

With oil prices down to less than $80 a barrel, these blue-chip businesses are available for a much cheaper price than usual. For instance, big oil firm ExxonMobil (XOM) is available for less than 12 times earnings… and now yields nearly 3%. Regardless of where oil goes from here, that’s a great price for a world-dominating business.

Today, you can take advantage of low oil prices to collect more income from quality oil producers. Together with low gasoline expenses, think of it as your own personal stimulus plan, sponsored by the free market.

Here’s to our health, wealth, and a great retirement,

Dr. David Eifrig

[ad#stansberry-ps]

Source: Daily Wealth