Typically, in The Safety Net column, I take a look at the dividend safety of a stock suggested by readers.

Typically, in The Safety Net column, I take a look at the dividend safety of a stock suggested by readers.

The subjects range from stocks like the popular Windstream Holdings (Nasdaq: WIN), which despite its extremely high yield surprisingly rates a B, to the lesser-known Nordic American Tankers Limited (NYSE: NAT), whose rating was not quite as strong, to put it politely.

I enjoy writing this column because I love diving into financial statements and picking apart the numbers. As you can imagine, I’m usually the life of the party.

[ad#Google Adsense 336×280-IA]I have my process for analyzing the dividend safety and it usually goes pretty smoothly.

But I don’t want to get placid, so today, I’m mixing it up and for the first time ever in the long and storied history of The Safety Net column, I’m looking at a mutual fund.

This week, Jan suggested I examine the Fidelity High Income Fund (Nasdaq: SPHIX), a bond fund that yields 5.4%

Nearly two-thirds of the portfolio is rated B or lower.

Over 83% are corporate bond funds with 8% in bank loans. Many of the bank loans are floating rate credits, which should help the fund a bit if and when interest rates rise.

But when rates rise, bond prices fall. That means the 83% of the portfolio that is invested in corporate bonds is going to get crushed when interest rates rise.

Just so there is no misunderstanding, when interest rates rise, this fund is going to lose money for its investors. The 5%+ yield is nice, but won’t be much comfort when the fund is down 10%.

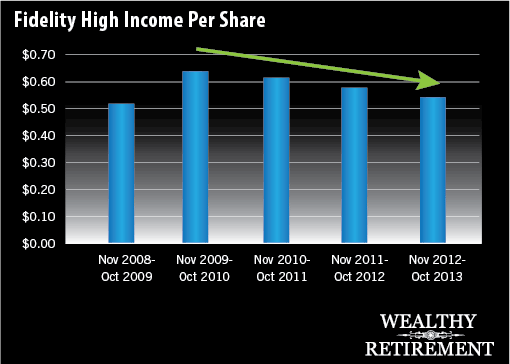

Moreover, income for investors is heading in the wrong direction.

From Bad to Worse

You can see from the chart below that over the past four years, the income per share paid to shareholders has declined.

To be fair, the fund’s bond holdings have likely had lower yields as rates fell over the past few years, so it’s not the fault of the fund manager.

To be fair, the fund’s bond holdings have likely had lower yields as rates fell over the past few years, so it’s not the fault of the fund manager.

But that means bupkis to an investor who is relying on steady income for living expenses.

When rates eventually rise, the income paid by the fund should go higher. However, again, the share price will fall as the value of the bonds in the portfolio declines. So in several years the yield may be higher, but the net asset value will be considerably lower.

Look Out Below

I share similar thoughts about bond funds as I do about stock mutual funds. You can do better and pay lower fees by setting up your own portfolio.

Most bond funds will fall when rates rise. Will it happen next year? I have no idea. But with rates at historically low levels for years, it is only a matter of time before it happens.

The best way to protect yourself from falling bond prices is to own individual bonds and hold them to maturity.

The Oxford Club’s Bond Strategist Steve McDonald is a master at picking undervalued bonds with great yields. These bonds will likely fall less since they’re undervalued to begin with. And if the plan is to hold to maturity, the market price does not matter.

Importantly, when you own individual bonds, you can rely on the income that the bond pays. It doesn’t fluctuate from year to year like a mutual fund.

Nothing against the Fidelity High Income Fund. The managers have done a decent job with it in the past. But it’s a bond fund with declining income per share and, like all bond funds, it will fall hard when interest rates rise.

The four-year history of declining income forces me to give it my lowest rating.

Dividend (Income) Safety Rating: F

— Marc Lichtenfeld

— Marc Lichtenfeld

[ad#IPM-article]

Source: Wealthy Retirement