The market is on a tear, making it harder than ever for dividend growth investors to find good buys for their money.

While many people expect the market will correct itself, you might be missing out on steady gains if the market continues to “melt up” thanks to low interest rates.

[ad#Google Adsense 336×280-IA]Fortunately, there’s a safe way to secure yield with upside to boot.

While the market has bid many well-known dividend payers up to silly prices (and caused yields to crash), there are still a few lesser known names paying 4% yields with plenty of payout and price runway from here.

We can create a growth portfolio with a 4% yield using a bit of careful selection. In order for us to do this, though, we need to go against the herd and buy into sectors that are relatively unpopular in today’s market.

That means avoiding the blue chip real estate investment trusts (REITs), which have seen tremendous inflows of cash from yield-hungry investors who sold off those same assets over the last couple of years. For example, Realty Income Corporation (O) is up 36% in 2016 alone, as investors have bid its yield (now 3.5%) down to a 30-year low! There are better buys, with more promising growth prospects, in nuanced issues that headline-obsessed investors miss completely.

A 3-Stock Portfolio That Pays 4% With Big Upside

Mercury General Corporation (MCY) is a rather boring insurance company. But boring is good, especially for us contrarian investors. Founded nearly 60 years ago, the company has developed into a multi-billion firm with an A-rating from credit agencies and more than 30 years of dividend growth at its back.

Too Boring for First-Level Investors

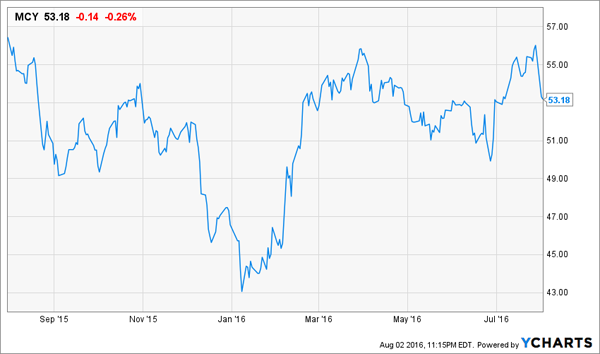

That hasn’t stopped the market from actually pricing this stock lower than it was a year ago. Insurance firms are out of favor because of low interest rates, which hurt their ability to make money on the float they collect. Still, Mercury has managed to grow profits in this tough environment:

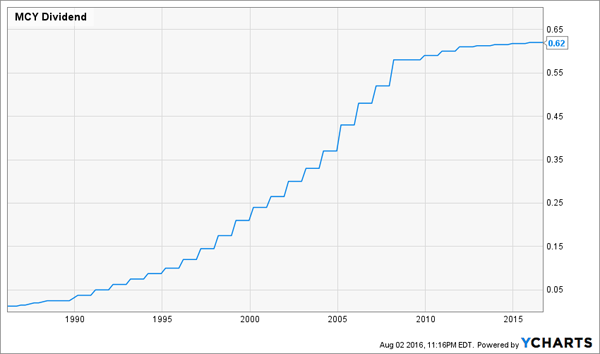

Mercury Grows Its Payout Despite Low Rates…

And the company’s free cash flow is growing – it’s currently is 150% of dividends, showing that payouts are extremely safe and likely to rise:

… And Has Plenty of Free Cash Flow To Raise Its Payout

This dividend growth machine pays 4.7% today, a dividend that is likely to double over the next decade.

Helmerich & Payne (HP) is an overlooked stock, partly because it’s hardly a house name (no, it’s not that HP). This HP is is almost a century old, with over a generation of dividend growth at its back. But there’s one caveat that explains its 4.5% yield: energy.

Energy Concerns Make a Price Ceiling

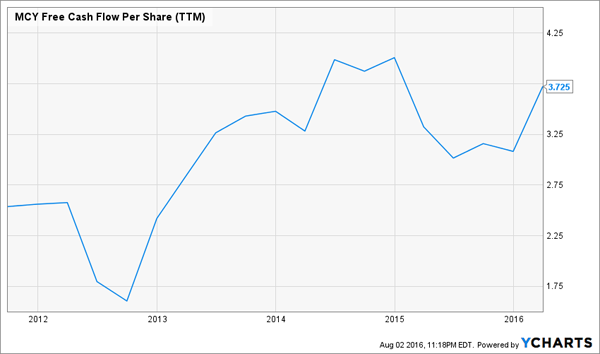

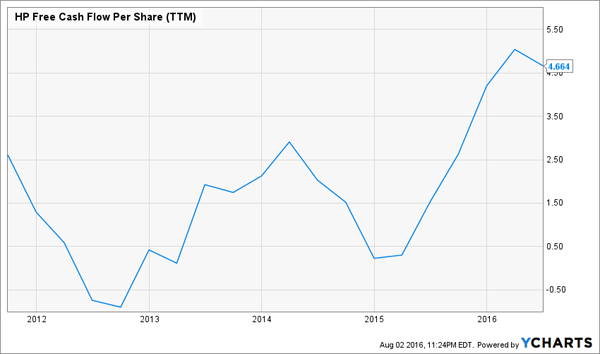

The weakness in the energy sector as a result of falling oil and gas prices has made all energy stocks weak performers for the last three years. That weakness is not over, especially since oil has fallen to around $40 per barrel in recent months and high output could keep oil low. But selling HP is throwing the baby out with the bathwater, because this company is still a cash generating machine, even as energy prices remain low:

Through Thick and Thin, Cash Pours In

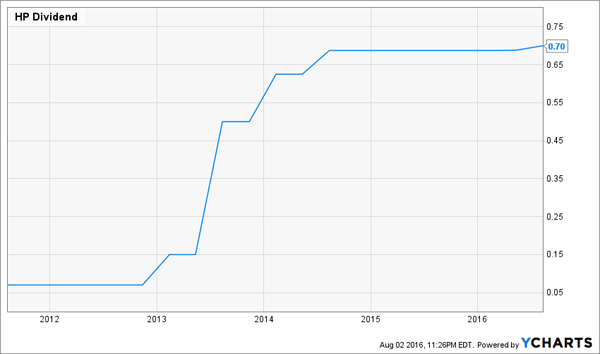

HP has been able to maintain strong (albeit volatile) cash flow over the last five years thanks in large part to prudent investment and the company’s strategic planning. Free cash flow is at a 5-year high, and is now 170% of payouts. Meanwhile, we’ve seen a recent lull in dividend growth for the firm:

HP’s Dividend Due For a Boost

A surprise dividend hike could cause the stock price to rise dramatically. And even if that doesn’t happen, buyers of HP still get a well-covered 4.5% dividend yield from a proven operator.

It has a stronger balance sheet than a “blue chip” like Chevron Corporation (CVX), with a higher yield to boot. Plus HP has strong cash flow while Chevron’s operating income fell last quarter by 21% despite a relatively calm energy market (as profits dangle in negative territory). Chevron may be the household name, but HP pays more and is better suited to withstand the volatility in energy markets.

Our third pick is another insurer – Old Republic International (ORI), a 3.9% payer.

The Beginning of a Recovery

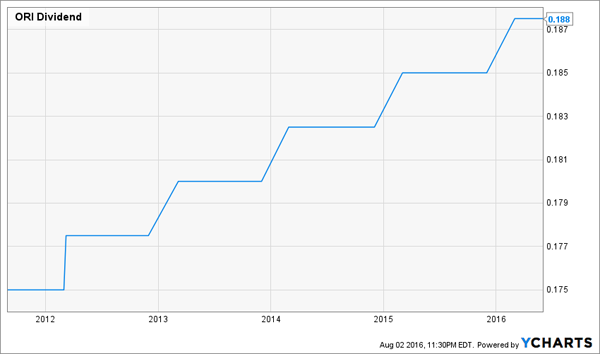

Already, investors are realizing the strength in ORI – it’s a rare financial firm with a stock price in positive territory over the last year. This is partly thanks to ORI’s continued dividend growth track record. It increased its payout again late last year:

Dividends Keep Going Up and To the Right

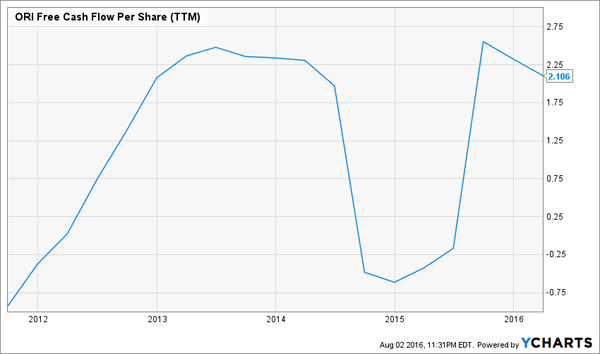

FCF per share shows that ORI is generating cash well in excess of what it’s paying out to investors—in fact, the ratio of FCF to paid dividends is a whopping 280%:

FCF Far Exceeds Payouts

With annual dividend payouts of 75 cents per share, and FCF per share at $2.10, the company could easily double its dividend today. Combine that with solid 5% year-over-year revenue growth, and we see why this stock has been showing strength. It will likely attract increasing attention as the current “dividend gold rush” extends into midcap names.

When we combine these stocks, we get a 4.3% yielding portfolio with both a history of dividend growth and strong growth prospects ahead. With this as a base, we can expand and diversify our portfolio further to boost our overall income stream and protect from a market downturn.

How do we do this? Simple—we look for uncorrelated high yielding assets that complement our dividend growth stocks that have so far been ignored or underpriced by the market. Adding these to our dividend portfolio gives us the potential for capital gains upside in addition to a higher overall portfolio yield.

— Brett Owens

Sponsored Link: A group of funds that pays even higher dividends—8% or more—remains forsaken by the market. But I haven’t forgotten, which is why I’ve made a list of their names, tickers, and my target prices for each of them. Click here and I’ll share with you which funds are paying over 8%, as well as what prices to buy them at.

Source: Contrarian Outlook